Welcome To Greener Candles!

Welcome To Greener Candles!

This crypto-focused #threadcast is packed with news & hot topics inviting all crypto enthusiasts to engage.

- Newbie friendly, ask questions, share your stuff!

- Also serves as a newsletter

- Curated alpha

- Join the fun and let's get this up there! 🟢

@mypathtofire 's laser eyes stay on 💪🤩

Indeed! 💪 Stay strong.

https://inleo.io/threads/view/idksamad78699/re-leothreads-yvgv7vtb?referral=idksamad78699

Excellent threadcast @brando28. I will add some crypto videos here.

Thats great sir 😊😊😊..

Thank you very much! And awesome that you add videos here 💪

The engagement has been a bit quiet so far although this just the third edition. Hope more crypto enthusiasts find it daily and add more content themselves 👌

Will Solana Price Reach $420 During the Festive Season?

Solana Price gains momentum with bullish trends and market support, hinting at potential gains for SOL amid festive season enthusiasm.

Solana price has gained notable momentum since early November, reflecting a strong bullish trend in the cryptocurrency market. Analysts are optimistic, projecting SOL could reach the $420 mark despite minor market corrections. The rally is fueled by Bitcoin surpassing $100K, enhancing market sentiment. With this upward momentum, Solana appears positioned for continued gains, maintaining investor confidence in the Layer 1 blockchain.

#solana #crypto #market

Can Solana Price Reach $420 During the Festive Season?

A prominent crypto analyst recently shared an analysis on X post, suggesting a potential price target of $420 for Solana. According to the chart shared in the post, Solana is currently resting on a robust upward trendline, serving as a strong support level.

The analyst pointed out that the price has shown consistent growth over the past months. The trendline indicates that Solana’s bullish momentum could continue as long as this critical support level holds firm. The forecast suggests that breaking key resistance levels might push Solana toward the $420 mark in this festive season, considered the next logical price target.

I love reading about crypto!

Thanks for sharing...

Glad to hear it, and thanks for commenting. 🙏 It helps to get this up there on the top of the page to gain more visibility.

I publish this daily so hope you keep following! 🙂🟢

Happy Weekend!

Today on Greener Candles:

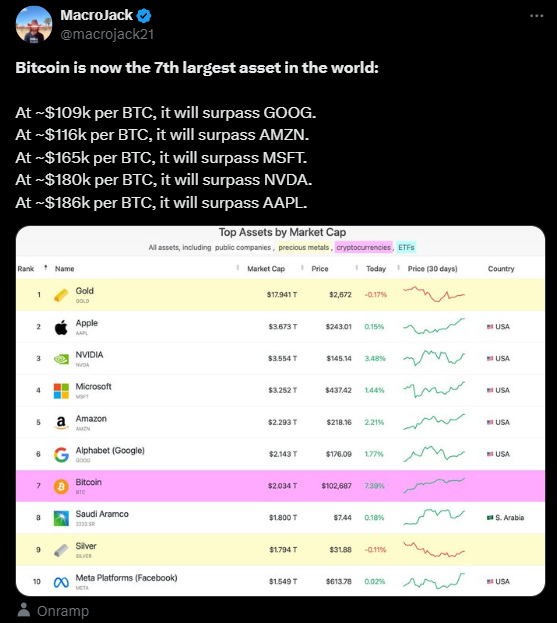

BTC MC about to take on Google and Amazon MCs next. 👀

Bitcoin outperforms commodities, equities, precious medals

Flat Earth Token

Who didn't see this coming? 😀

AI Sector

AI agents battling each other... not sure if this real though 😅

Link to a LONG full thread:

Some of the AI Agent tokens out there.

Expect more to come, much more.

#ai

Venture Capitalists Bearish On Crypto-AI Projects.

TL;DR:

#crypto #ai #technology

Link to the article:

https://www.theblock.co/post/329777/vcs-express-skepticism-towards-crypto-ai-projects-almost-everyone-will-lose-a-lot-of-money?utm_source=twitter&utm_medium=social

A lot of interesting stuff happening on the Cosmos chain.

In my opinion, perhaps the most under estimated network.

#crypto

ChainLink Getting a Lot of Attention

$LINK next pump?

Watch These Signals To Discover Tokens Early

#solana

Thoughts On XRP Hatred

Mass Adaptation Next?

Choose Your Fighter! 🐶

#memecoins

Top Exchanges

https://inleo.io/threads/view/onealfa/re-leothreads-2fjssbijd?referral=onealfa

BTC vs. ETH vs. ALTs

Zero1 Under a Bot Attack

!summarize #bitcoin #florida #crypto

This guys always was a jackass.

!summarize #bitcoin #reserve #assets #unitedstates

!summarize #bitcoin #maxkeiser

!summarize #bitcoin #crypto

!summarize #crypto

!summarize #ripple #trump #xrp

!summarize #xrp #ripple #crypto

!summarize #ripple #xrp #crypto

!summarize #ripple #xrp

!summarize #xrp #ripple

!summarize #bitcoin #adoption

Crypto Trader Predicts Incoming Rallies for Ethereum, Says New Dogecoin All-Time High ‘A Formality at This Point’

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

Trader Justin Bennett tells his 115,200 followers on the social media platform X that Ethereum bulls are in full control as long as ETH is trading above an immediate support level.

According to Bennett, Ethereum could get a quick sprint if ETH continues to flash strength in its Bitcoin pair (ETH/BTC)

#bitcoin #crypto #ethereum #investing #doge

“Bullish on ETH while above this $3,950 area with a $5,000 target.

Could happen quickly if ETH/BTC can flip that 4% area on the weekly chart.”

Looking at the ETH/BTC chart, the crypto strategist says Ethereum will likely gather more bullish momentum if the pair flips the 0.04 BTC resistance into support.

“ETH will get really interesting if ETH/BTC can reclaim this channel on the weekly chart.

Testing resistance now.”

!summarize #bitcoin #marcandreeson

!summarize #mstr #microstrategy #michaelsaylor #bitcoin

Proposed Argentine Legislation to Recognize Crypto Mining as Key Economic Activity

Argentine Senator Ezequiel Atauche proposes inclusion of cryptocurrency mining in Knowledge Economy Promotion Law No. 27,506.

Proposal aims to extend tax incentives to blockchain technology, aligning with sectors like AI and biotechnology.

#argentina #crypto #mining #economy

Argentine Senator Ezequiel Atauche recently proposed an amendment to Law No. 27,506, the Law of Promotion of the Knowledge Economy, to include cryptocurrency mining and blockchain technology among the activities eligible for fiscal incentives.

Enacted in 2019, this law aims to stimulate sectors that are intensive in technology and knowledge through tax benefits, enhancing development and creating high-quality jobs in areas of high innovation.

The document disclosed that “the Law for the Promotion Regime of the Knowledge Economy (27,506) was enacted in Argentina in 2019 and aims to promote knowledge and technology intensive activities through tax benefits, contributing to the development and generation of quality employment in high innovation sectors. Promoted activities include: software, biotechnology, artificial intelligence, professional services, audiovisual industry, and several others related to the knowledge economy”.

How incoming crypto-friendly SEC boss Paul Atkins may actually cool sizzling rally

Questions surround whether Atkins will drop the SEC’s case against Ripple, which offers the XRP token.

One dominant investing narrative coming out of the nomination of long-time securities lawyer, former SEC commissioner and crypto believer Paul Atkins as Securities and Exchange Commission chair is that he will be great for the $3.5-plus trillion digital-coin business.

#xrp #sec #paulatkins #crypto #stocks

President-elect Trump said as much when he announced Atkins as Wall Street’s top cop Wednesday afternoon (of course, after it was reported in the Post two weeks ago, he was the front-runner).

Atkins, Trump posted on Truth Social, “recognizes that digital assets and other innovations are crucial to Making America Greater than Ever Before.”

!summarize #crypto #bitcoin #caitlinlong

!summarize #bitcoin #planb #Price

!summarize #bitcoin #realestate #crypto

#crypto #btc

!summarize

#crypto #btc

!summarize

#crypto #btc

!summarize