I set a crazy challenge for myself to power up 3172 Hive Power until the end of the year. After 5 days, I powered up 1018. So only 2154 remaining and 23 days left :-)

#liotes

Embracing one's idiosyncratic lexicon over reliance on algorithmically orchestrated language models entails a discernible predilection for linguistic autonomy, an eschewal of mechanized verbosity. Such proclivity cultivates a discourse replete with sesquipedalian verbiage and an ineffable concatenation of seldom-employed lexemes, fostering an obfuscatory yet eminently perspicacious aura. Paradoxically, the juxtaposition of organic, meticulously curated diction against the perfunctory omniscience of machine-generated parlance reveals the intrinsic human predilection for esoteric expressiveness—a phenomenon large language models, constrained by probabilistic lexical regurgitation, ostensibly emulate yet invariably dilute.

Caught talking about you. lol. I do a lot of looking around, I do a lot of research, I am always looking for support for my witness. I seen your snaps, and you where active, so I just threw out the question.

I think it's because this is higher level than most people could comfortably read, while LLM generated text is written at the level of the general public average reading skills.

Unless you prompt it to write why you should use your own lexicon over using the lexicon of large language models because your words will be more relatable. Ask to use the most complicated and seldom used words to make it ironic.

The world’s oldest dog lived to 29.5 years old. While the median age a dog reaches tends to be about 10-15 years, one Australian cattle dog, ‘Bluey’, survived to the ripe old age of 29.5.

Thank you very much! And awesome that you add videos here 💪

The engagement has been a bit quiet so far although this just the third edition. Hope more crypto enthusiasts find it daily and add more content themselves 👌

Solana Price gains momentum with bullish trends and market support, hinting at potential gains for SOL amid festive season enthusiasm.

Solana price has gained notable momentum since early November, reflecting a strong bullish trend in the cryptocurrency market. Analysts are optimistic, projecting SOL could reach the $420 mark despite minor market corrections. The rally is fueled by Bitcoin surpassing $100K, enhancing market sentiment. With this upward momentum, Solana appears positioned for continued gains, maintaining investor confidence in the Layer 1 blockchain.

Can Solana Price Reach $420 During the Festive Season?

A prominent crypto analyst recently shared an analysis on X post, suggesting a potential price target of $420 for Solana. According to the chart shared in the post, Solana is currently resting on a robust upward trendline, serving as a strong support level.

The analyst pointed out that the price has shown consistent growth over the past months. The trendline indicates that Solana’s bullish momentum could continue as long as this critical support level holds firm. The forecast suggests that breaking key resistance levels might push Solana toward the $420 mark in this festive season, considered the next logical price target.

Venture Capitalists Bearish On Crypto-AI Projects.

TL;DR:

Two VCs don't believe in decentralized AI projects but are instead betting on big companies such as Meta & OpenAI.

It's really not as bearish as the clickbait title would make you think. The other dude actually sounds a bit bullish on the AI-Agent sector and the possibilities it has to offer.

#crypto #ai #technology

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

Trader Justin Bennett tells his 115,200 followers on the social media platform X that Ethereum bulls are in full control as long as ETH is trading above an immediate support level.

According to Bennett, Ethereum could get a quick sprint if ETH continues to flash strength in its Bitcoin pair (ETH/BTC)

Looking at the ETH/BTC chart, the crypto strategist says Ethereum will likely gather more bullish momentum if the pair flips the 0.04 BTC resistance into support.

“ETH will get really interesting if ETH/BTC can reclaim this channel on the weekly chart.

Argentine Senator Ezequiel Atauche proposes inclusion of cryptocurrency mining in Knowledge Economy Promotion Law No. 27,506.

Proposal aims to extend tax incentives to blockchain technology, aligning with sectors like AI and biotechnology.

Argentine Senator Ezequiel Atauche recently proposed an amendment to Law No. 27,506, the Law of Promotion of the Knowledge Economy, to include cryptocurrency mining and blockchain technology among the activities eligible for fiscal incentives.

Enacted in 2019, this law aims to stimulate sectors that are intensive in technology and knowledge through tax benefits, enhancing development and creating high-quality jobs in areas of high innovation.

The document disclosed that “the Law for the Promotion Regime of the Knowledge Economy (27,506) was enacted in Argentina in 2019 and aims to promote knowledge and technology intensive activities through tax benefits, contributing to the development and generation of quality employment in high innovation sectors. Promoted activities include: software, biotechnology, artificial intelligence, professional services, audiovisual industry, and several others related to the knowledge economy”.

Questions surround whether Atkins will drop the SEC’s case against Ripple, which offers the XRP token.

One dominant investing narrative coming out of the nomination of long-time securities lawyer, former SEC commissioner and crypto believer Paul Atkins as Securities and Exchange Commission chair is that he will be great for the $3.5-plus trillion digital-coin business.

President-elect Trump said as much when he announced Atkins as Wall Street’s top cop Wednesday afternoon (of course, after it was reported in the Post two weeks ago, he was the front-runner).

Atkins, Trump posted on Truth Social, “recognizes that digital assets and other innovations are crucial to Making America Greater than Ever Before.”

Hi guys, this is my second post here.

My channel is for showing a little of my life in Brazil, this particular photo is from Rio Grande do Norte state.

Even if the weights are the same - 10 kg, the left side has more pull because the weight is farther from the center. Thus, the scale should tip to the left.

Hey Nifty, have you seen my T-shirt shop by chance? I'm trying to reach a goal of 10k in revenue this year and I'm so close. So I'm asking people to share this link around to their friends and family.

that is a pretty vague question :) more details would be nice. If you talk about LeoDex you should be able to use it with Keystore. If you are talking about some other dex on hive, you got hive keys when making the account.

A wallet that I used in 2021 and abandoned some useless shitcoin in it sent me an email message asking me to check my wallet because my useless shitcoin has done 450% increase.$0.40 balance then is now $45.

@pepetoken just sent you a DIY token as a little appreciation for your comment dear @thelastdash!

Feel free to multiply it by sending someone else !DIY in a comment :) You can do that x times a day depending on your balance so:

Mad Ogre Anarchist is a monster card that came into the game with the introduction of the Rebellion edition and comes under the core Rebellion card set. This monster belongs to the Neutral element and its attack type is melee.

It costs only 6 mana to be used in battles and it is a Rare type card & needs a total of 115 BCXs of cards to upgrade this card to max level. Apart from a decent attack power and speed, this card also has a good combo of armour and health and it also comes with 2 abilities.

My day is going well but right now it seems My football club (Chelsea FC) wants to break my heart as they are losing to Tottenham , I hope they equalise and win the match

What's up? It's the end of the day and my day was good and productive but busy. The disappointing thing is that I lost more than 2 hours just because of a traffic jam which made me feel irritated. I wish there were no traffic jam.

The San Francisco Bay Area remains North America's top tech talent hub.

With Silicon Valley giants like Apple and Google, the region added over 68,000 tech workers between 2018 and 2023--a growth of 18.6%.

Here, we visualize the biggest tech talent hubs in North America, highlighting job numbers and growth rates from 2018 to 2023

The recent performances of ADA are impressive: +89% in two weeks to peak at $1.33, its highest level in three years. However, this momentum is not limited to prices. The Cardano network shows significant advancements

I can never take my dog to the park because the ducks keep trying to bite him. I guess that’s what I get for buying a pure bread dog. Credit: reddit $LOLZ on behalf of ben.haase

I'm pretty certain it will tip to the right, but not entirely sure.. I guess that there's a mathematical solution to this, but I might just have to set up a simulation for this regardless, to see it with my own eyes.

As history often repeats itself, the current market structure suggests a bullish continuation. Analysts predict that this pre-altseason phase could develop into a full-fledged altcoin rally, similar to 2017

I set a crazy challenge for myself to power up 3172 Hive Power until the end of the year. After 5 days, I powered up 1018. So only 2154 remaining and 23 days left :-)

#liotes

Good Luck!

Thanks !

good luck! You can do this!

Thanks man. I hope I'll manage :-)

Thats a big goal! But looks like you got of to a strong start 👏

I was far behind my goals at the beginning of December and needed to kick myself a bit :-)

Yes, you can get it before your current goal :)

It looks good :-)

sure fren

Best of luck to you.

Thank you!

How did you do it Keep?

A bit from HBD, a bit from hive-engine, a bit from content creation and of course also curation rewards.

oh ok, it looks like I need to step it up. are you on premium?

No I'm not on premium for the moment.

Oh ok, me neither... for the moment.

Embracing one's idiosyncratic lexicon over reliance on algorithmically orchestrated language models entails a discernible predilection for linguistic autonomy, an eschewal of mechanized verbosity. Such proclivity cultivates a discourse replete with sesquipedalian verbiage and an ineffable concatenation of seldom-employed lexemes, fostering an obfuscatory yet eminently perspicacious aura. Paradoxically, the juxtaposition of organic, meticulously curated diction against the perfunctory omniscience of machine-generated parlance reveals the intrinsic human predilection for esoteric expressiveness—a phenomenon large language models, constrained by probabilistic lexical regurgitation, ostensibly emulate yet invariably dilute.

#words

Holy fuck man, you made me feel like I had to go back to Harvard. lmfao !BBH !DOOK !PIMP

Haha. Ironic isn't it?

Now if we can get acidyo to support my witness ;)

How did that even come to your mind in this context?

Yeah, I don't know either 🤷♂

Caught talking about you. lol. I do a lot of looking around, I do a lot of research, I am always looking for support for my witness. I seen your snaps, and you where active, so I just threw out the question.

I did send you a freind request on Discord a couple months ago. lol

🤔 Have you asked?

No, he is a whale, afraid to. lol

!INDEED it is my friend :) !BBH !DOOK

@bradleyarrow likes your content! so I just sent 1 BBH(22/100)@alex-rourke! to your account on behalf of @bradleyarrow.

(html comment removed: )

)

Nailed it!!!! 🤣

Spot on, right? 😄

Can someone interpret this in footballing terms?

😄 Right?

LLMs text feels machine generated whereas one's natural voice is way more readable and friendly, unless you write like this of course.

I dunno why this sounds more machine-like than actual LLM generated text. !LOLZ

Oh the irony 😄

I think it's because this is higher level than most people could comfortably read, while LLM generated text is written at the level of the general public average reading skills.

Unless you prompt it to write why you should use your own lexicon over using the lexicon of large language models because your words will be more relatable. Ask to use the most complicated and seldom used words to make it ironic.

lolztoken.com

Can't live with it can't live meow it.

Credit: reddit

$LOLZ on behalf of ahmadmanga

(3/4)

PLAY & EARN $DOOM

@alex-rourke, I sent you an@bradleyarrow likes your content! so I just sent 1 BBH(21/100)@alex-rourke! to your account on behalf of @bradleyarrow.

(html comment removed: )

)

Now I need to get my dictionary first , lmao

I'm very surprised at how high the value rose, maybe because I'm new here so this might not be surprising to the old ones.

I'm happy to see both Leo and Hive pick up like this

Did you know??

#facts #pets #dailydook

Interesting fact. Keep posting these. It is great to feed #leoai.

That dog died older than I'm right now, incredible

This crypto-focused #threadcast is packed with news & hot topics inviting all crypto enthusiasts to engage.

#crypto

@mypathtofire 's laser eyes stay on 💪🤩

Indeed! 💪 Stay strong.

https://inleo.io/threads/view/idksamad78699/re-leothreads-yvgv7vtb?referral=idksamad78699

Excellent threadcast @brando28. I will add some crypto videos here.

Thats great sir 😊😊😊..

Thank you very much! And awesome that you add videos here 💪

The engagement has been a bit quiet so far although this just the third edition. Hope more crypto enthusiasts find it daily and add more content themselves 👌

Will Solana Price Reach $420 During the Festive Season?

Solana Price gains momentum with bullish trends and market support, hinting at potential gains for SOL amid festive season enthusiasm.

Solana price has gained notable momentum since early November, reflecting a strong bullish trend in the cryptocurrency market. Analysts are optimistic, projecting SOL could reach the $420 mark despite minor market corrections. The rally is fueled by Bitcoin surpassing $100K, enhancing market sentiment. With this upward momentum, Solana appears positioned for continued gains, maintaining investor confidence in the Layer 1 blockchain.

#solana #crypto #market

Can Solana Price Reach $420 During the Festive Season?

A prominent crypto analyst recently shared an analysis on X post, suggesting a potential price target of $420 for Solana. According to the chart shared in the post, Solana is currently resting on a robust upward trendline, serving as a strong support level.

The analyst pointed out that the price has shown consistent growth over the past months. The trendline indicates that Solana’s bullish momentum could continue as long as this critical support level holds firm. The forecast suggests that breaking key resistance levels might push Solana toward the $420 mark in this festive season, considered the next logical price target.

I love reading about crypto!

Thanks for sharing...

Glad to hear it, and thanks for commenting. 🙏 It helps to get this up there on the top of the page to gain more visibility.

I publish this daily so hope you keep following! 🙂🟢

Happy Weekend!

Today on Greener Candles:

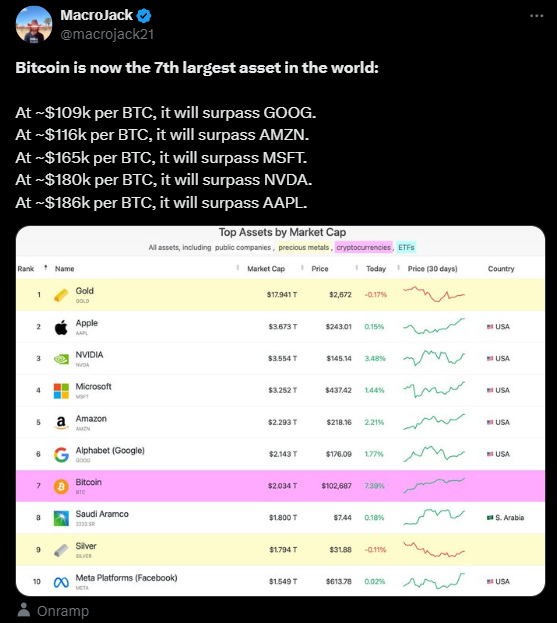

BTC MC about to take on Google and Amazon MCs next. 👀

Bitcoin outperforms commodities, equities, precious medals

Flat Earth Token

Who didn't see this coming? 😀

AI Sector

AI agents battling each other... not sure if this real though 😅

Link to a LONG full thread:

Some of the AI Agent tokens out there.

Expect more to come, much more.

#ai

Venture Capitalists Bearish On Crypto-AI Projects.

TL;DR:

#crypto #ai #technology

Link to the article:

https://www.theblock.co/post/329777/vcs-express-skepticism-towards-crypto-ai-projects-almost-everyone-will-lose-a-lot-of-money?utm_source=twitter&utm_medium=social

A lot of interesting stuff happening on the Cosmos chain.

In my opinion, perhaps the most under estimated network.

#crypto

ChainLink Getting a Lot of Attention

$LINK next pump?

Watch These Signals To Discover Tokens Early

#solana

Thoughts On XRP Hatred

Mass Adaptation Next?

Choose Your Fighter! 🐶

#memecoins

Top Exchanges

https://inleo.io/threads/view/onealfa/re-leothreads-2fjssbijd?referral=onealfa

BTC vs. ETH vs. ALTs

Zero1 Under a Bot Attack

!summarize #bitcoin #florida #crypto

This guys always was a jackass.

!summarize #bitcoin #reserve #assets #unitedstates

!summarize #bitcoin #maxkeiser

!summarize #bitcoin #crypto

!summarize #crypto

!summarize #ripple #trump #xrp

!summarize #xrp #ripple #crypto

!summarize #ripple #xrp #crypto

!summarize #ripple #xrp

!summarize #xrp #ripple

!summarize #bitcoin #adoption

Crypto Trader Predicts Incoming Rallies for Ethereum, Says New Dogecoin All-Time High ‘A Formality at This Point’

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

A closely followed crypto strategist thinks Ethereum (ETH) is now in a solid position to print new all-time highs.

Trader Justin Bennett tells his 115,200 followers on the social media platform X that Ethereum bulls are in full control as long as ETH is trading above an immediate support level.

According to Bennett, Ethereum could get a quick sprint if ETH continues to flash strength in its Bitcoin pair (ETH/BTC)

#bitcoin #crypto #ethereum #investing #doge

“Bullish on ETH while above this $3,950 area with a $5,000 target.

Could happen quickly if ETH/BTC can flip that 4% area on the weekly chart.”

Looking at the ETH/BTC chart, the crypto strategist says Ethereum will likely gather more bullish momentum if the pair flips the 0.04 BTC resistance into support.

“ETH will get really interesting if ETH/BTC can reclaim this channel on the weekly chart.

Testing resistance now.”

!summarize #bitcoin #marcandreeson

!summarize #mstr #microstrategy #michaelsaylor #bitcoin

Proposed Argentine Legislation to Recognize Crypto Mining as Key Economic Activity

Argentine Senator Ezequiel Atauche proposes inclusion of cryptocurrency mining in Knowledge Economy Promotion Law No. 27,506.

Proposal aims to extend tax incentives to blockchain technology, aligning with sectors like AI and biotechnology.

#argentina #crypto #mining #economy

Argentine Senator Ezequiel Atauche recently proposed an amendment to Law No. 27,506, the Law of Promotion of the Knowledge Economy, to include cryptocurrency mining and blockchain technology among the activities eligible for fiscal incentives.

Enacted in 2019, this law aims to stimulate sectors that are intensive in technology and knowledge through tax benefits, enhancing development and creating high-quality jobs in areas of high innovation.

The document disclosed that “the Law for the Promotion Regime of the Knowledge Economy (27,506) was enacted in Argentina in 2019 and aims to promote knowledge and technology intensive activities through tax benefits, contributing to the development and generation of quality employment in high innovation sectors. Promoted activities include: software, biotechnology, artificial intelligence, professional services, audiovisual industry, and several others related to the knowledge economy”.

How incoming crypto-friendly SEC boss Paul Atkins may actually cool sizzling rally

Questions surround whether Atkins will drop the SEC’s case against Ripple, which offers the XRP token.

One dominant investing narrative coming out of the nomination of long-time securities lawyer, former SEC commissioner and crypto believer Paul Atkins as Securities and Exchange Commission chair is that he will be great for the $3.5-plus trillion digital-coin business.

#xrp #sec #paulatkins #crypto #stocks

President-elect Trump said as much when he announced Atkins as Wall Street’s top cop Wednesday afternoon (of course, after it was reported in the Post two weeks ago, he was the front-runner).

Atkins, Trump posted on Truth Social, “recognizes that digital assets and other innovations are crucial to Making America Greater than Ever Before.”

!summarize #crypto #bitcoin #caitlinlong

!summarize #bitcoin #planb #Price

!summarize #bitcoin #realestate #crypto

#crypto #btc

!summarize

#crypto #btc

!summarize

#crypto #btc

!summarize

Hi guys, this is my second post here.

My channel is for showing a little of my life in Brazil, this particular photo is from Rio Grande do Norte state.

away no make up, no filters, just

Keep the posts coming :) !BBH !DOOK

@bradleyarrow likes your content! so I just sent 1 BBH(17/100)@livinginbrazil! to your account on behalf of @bradleyarrow.

(html comment removed: )

)

Any guide on how to use Dash? Can it be use to swap and sell $hive and $hbd?

Hive, the Bull is moving!

SOURCE : Yahoo Finance

#news #bitcoin #cent

Which Instrument can you play very well, just starting to build interest around playing the keyboard or piano

#thread

I believe Google Search will change greatly by 2025. I mean it has to right 🤣🤔

Needs to be smarter to answer harder questions, while AI keeps improving to find useful, trustworthy content to train on

Search as an entity is dead. They will try to hand on but chatbots will take it all away. We are not going to dedicated sites to find stuff.

I agree one hundred with you, as an entity is dead

That's it, AI is taking over asap.

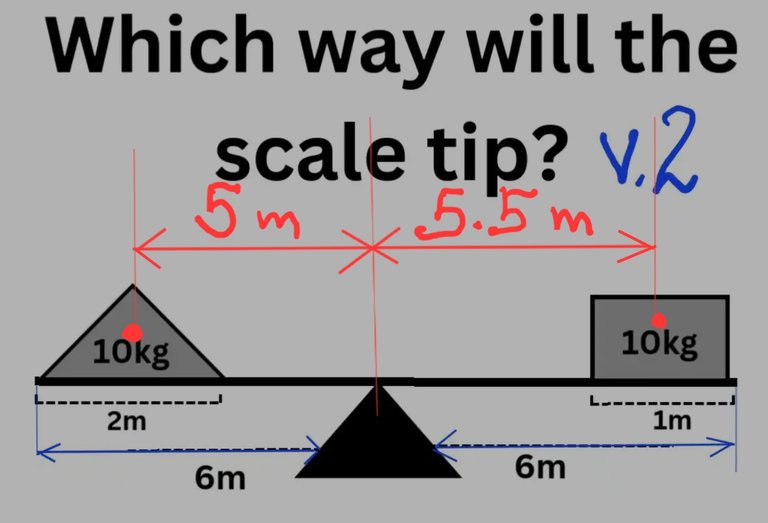

Ver.2 ( and a spoiler to ver.1)

Right. More weight towards the end of the lever.

Even if the weights are the same - 10 kg, the left side has more pull because the weight is farther from the center. Thus, the scale should tip to the left.

IMHO, wrong.

My solution:

Got it, thanks for the explanation!

The right side have lesser distance, so I think it will move towards the direction

To the left

To the right.

This is some Physics level shit. I left it since I was an undergraduate and ain't going back. Good luck to those who'll attempt to solve it.

Left side pull- 10x(6-1)= 50 kg-m

Right-side pull- 10x(6-0.5)= 55 kg-m

So the one which has more lever arm

right side

1/5 ⬇️ Hi guys! Vote for your Lion artisan of the Week N° 29 : Be sure to check out every post in this Thread! ⬇️

#polls #hivediy #poll #weeklytops #topauthors #inleo

4/5 Aluminum handicraft / Scale models

#hivediy

https://inleo.io/@fixie/turning-a-soda-can-into-batman-arkham-knight-transformo-una-lata-de-refresco-en-batman-caballero-de-arkham-engesp-2rp

Mi voto es para este artesano es muy talentoso.

Handicrafts

#hivediy

https://inleo.io/@yolimarag/esping-santa-claus-in-a-candy-jar-christmas-project-an1

Apoyada

Gracias mi @sacra97 🤗

Siempre apoyando mi bella.

Apoyando a la creadora de estupendas prendas 🙂👀🫂🙋🏽♀️😊

3/5 Crochet Art

#hivediy

https://inleo.io/@yunacrochet/jirafa-tejida-a-crochet--hka

5/5 Handicrafts

#hivediy

https://inleo.io/@marile21/mis-margaritas-en-limpiapipas-my-daisies-in-pipe-cleaners-je9

Apoyando a mi artesana favorita #polls #hivediy #poll #weeklytops #topauthors #inleo

I would really like to learn more about LBI token, I've read some interesting posts...

I think we can find more info on their official blog.

You can find it here. ⬇️

@lbi-token

buying college text books for flip in jan/Feb season. #business

Damn yo.... is there anything you won't flip?

nah lol not really. arbitrage is everywhere,

true true.... for me it's about calculating of there's enough arbitrage to make it worthwhile

that's the key to all of it.

haha yes I guess. Thanks 👍

Hey Nifty, have you seen my T-shirt shop by chance? I'm trying to reach a goal of 10k in revenue this year and I'm so close. So I'm asking people to share this link around to their friends and family.

How much do you plan to sell it for ??

my targets are anything with 50%+ margin. i generally buy in the $16 range and sell for $40+ but the pries always vary

Is it an investment that you will do?

It sounds interesting to learn about investments..

GM :)

yeah, i've been reselling books, dvds, cds, vhs... for a couple years now. this is a new strategy. never really done seasonal stuff like this

How do you sell them

Do you usually publish them on Amazon?

i sell on amazon and ebay

That's awesome fren!

just crossing $75k in used media sales for the year

This is really something huge, isn't it?

Thanks you very much for tis info.

I will try..

good luck!

You don't stop do you? lol

Rainforest, and we are destroying by the minute, to put solar panels up instead! 🤦🏼♂️ #meme #leomemes #meme #notmymeme

DASH in INLEO is something completely unbelievable... #dash #inleoearningandtrading leodex is awesome for trading my dear friend, try ;)))

#Dash is definitely an OG in this space. Everyone must have a little exposure to this.

Take A Look At That :)

#hive #crypto

How do I access Dex? Where Is my Active key?

Thanks.

that is a pretty vague question :) more details would be nice. If you talk about LeoDex you should be able to use it with Keystore. If you are talking about some other dex on hive, you got hive keys when making the account.

thanks!

I made a thing today!!!!!

Very easy btw

hold on did you say easy 😳😳😳 that thing is beautiful and you made it easily, wow

The best things in life are easy!

i really gotta follow you for more quotes like this

Innovant

Diversifying a portfolio in Hive bockchain is interesting...

What do you know about #gifu token...?

One of my favorite tokens!

#gifu

Our future and our freedom, protected by Dash.

#dash #crypto

If you suddenly become debanked, and don't know how you're going to pay your bills, don't worry, you can use Dash.

Spritz is one of the best ways of doing this:

https://spritz.finance/dash

This image is beautiful

Did you make it with AI? If so, what tools did you use to create the image?

Morning ☕

Hey from X!

Hey from InLeo ;)

hey!

Today in the morning I had a delicious coffee!

Good morning! I was reading a bit about #gifu for some reasons for this 2025. 🚀 #bbh #cent

#gifu

A dramatic scene of a lone adventurer, worn and weary, standing victorious amidst the lush https://img.inleo.io/DQmZheUQEZV7fDtY1VB6ejdx2ZrR4ri9s96VErCeg7mUeHH/Leonardo_Phoenix_A_dramatic_scene_of_a_lone_adventurer_worn_an_3%20(1).jpg

Nice image fren..

Making with AI right?

yes

Top 10 CEXs By Market Share In November 2024

Binance remains number one CEX , bravo

Binance, the tallest and Bybit has made significant progress.

A wallet that I used in 2021 and abandoned some useless shitcoin in it sent me an email message asking me to check my wallet because my useless shitcoin has done 450% increase.$0.40 balance then is now $45.

This is great, the same story that happened with SHIBA!

Berry noice man. !BBH !DIY !DOOK

@pepetoken likes your content! so I just sent 1 BBH(15/100)@thelastdash! to your account on behalf of @pepetoken.

(html comment removed: )

)

You can query your personal balance by

@pepetoken just sent you a DIY token as a little appreciation for your comment dear @thelastdash! Feel free to multiply it by sending someone else !DIY in a comment :) You can do that x times a day depending on your balance so:!DIYSTATShello

Hello

Welcome!

Hi and welcome!

Mad Ogre Anarchist is a monster card that came into the game with the introduction of the Rebellion edition and comes under the core Rebellion card set. This monster belongs to the Neutral element and its attack type is melee.

#threadstorm #outreach

1/🧵

https://img.inleo.io/DQmPjPXFFqu1tecd5Y2JmfgoinBYj6rs4U7B5qDPGxHpphF/LAVA%20(53).jpg

It costs only 6 mana to be used in battles and it is a Rare type card & needs a total of 115 BCXs of cards to upgrade this card to max level. Apart from a decent attack power and speed, this card also has a good combo of armour and health and it also comes with 2 abilities.

2/🧵

If you are interested, Please read my full blog post below!

Link - https://inleo.io/@mango-juice/splinterlands-mad-ogre-anarchist-is-a-deadly-opportunity-monster-foh

3/🧵

I like to use SET CHAOS magic cards for many reasons, I think it is much more economical and cost effective!

Do you usually play in Wild or modern format?

Some intellectuals are pushing for 80 hours a week. But that will be counter-productive.

India at 56 hours ?? That is really high

Happy Sunday! Hope everyone has an awesome day 😎 #freecompliments

Not bad! And you?

My day is going well but right now it seems My football club (Chelsea FC) wants to break my heart as they are losing to Tottenham , I hope they equalise and win the match

Thanks my friend, the same to you. Best regards.

right back at ya!

Unhappy meal

#meme

I don't like the food at McDonalds, I think this will soon be over...

So many bad reviews! good morning 👍

Good morning man! I thought as much 🥶🥶🥶..

Lets go play in the snow 🌨️🌨️🌨️..

Avoid restaurant food for a healthy lifestyle.

I cook 87% of things I eat...

That's good. now set the target to reach above 90%.

Just kidding.

We can make it 101%

Lol

Macdonalds is a restaurant like a tent is a hotel!

perfect for that one date when you want to break up

Oh my goodness!!! 😂😂😂😂😂

What's up? It's the end of the day and my day was good and productive but busy. The disappointing thing is that I lost more than 2 hours just because of a traffic jam which made me feel irritated. I wish there were no traffic jam.

#day #activity #trafficjam #cent #dailydook #freecomplimemnts

hahahaha this usually happens, when it does I start reading some posts xd

I don't use my smartphone when I am in vehicles because of security reason. I may end up losing my phone in such a case.

I would like to make a post soon on #splinterlands explaining something about some LANDS I want to acquire soon. #cent #bbh

man you spam a lot

How often do you think a thread can be made?

as often as you want. But your content is just spam about keywords.

You sound like a bot. Not someone truly engaging.

You are wrong brother!

really? Then why all the spam posts about keywords?

I can really post whatever I want bro 😃

The San Francisco Bay Area remains North America's top tech talent hub.

With Silicon Valley giants like Apple and Google, the region added over 68,000 tech workers between 2018 and 2023--a growth of 18.6%.

Here, we visualize the biggest tech talent hubs in North America, highlighting job numbers and growth rates from 2018 to 2023

IT service sector has grown exponentially over the last 7/8 years.

$LEO is about to reach $0.10, this will be like BTC reaching 100k.

Let us welcome these new Hivians on Hive!

https://inleo.io/@rzc24-nftbbg/welcoming-new-hivians-insights-from-a-reddit-ama-38q

#cent #bbh #welcome

does anyone remember stubby bear bottles?

Not really, can you send me a google image? xd

Mmmm not sure!

I am old . lol

xd

@cryptothesis asked this valid question

What do you think ??

#bitcoin #us #cent

The recent performances of ADA are impressive: +89% in two weeks to peak at $1.33, its highest level in three years. However, this momentum is not limited to prices. The Cardano network shows significant advancements

#ada #cent

Pump it!!

#Dash #crypto #dash #meme

😂

Amazing! 😀

I prefer 1.8k or 2k per dash 😎

Hahaha! I f**kn love the image!

Someone is taking Christmas very seriously this year…

Good photo. 📷

Holy Christmas tree ☺️☺️☺️☺️...

Merry Christmas man!

!DOOK

big balls !LOLZ

lolztoken.com

I guess that’s what I get for buying a pure bread dog.

Credit: reddit

$LOLZ on behalf of ben.haase

(3/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP@solymi, I sent you an

This year will be a lot of fun.

very seriously 😍😍😍😍😍 o thought I was prepared but whoever did this is in godmode and Santa is proud

Hi, @solymi,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

Se siente el ambiente navideño

We just introduced a change on fees and a new delegation system in Hive P2P

See my latest post to know all about it 👇

I would like to know more about this project!

Awesome! In my profile are different blogs about it

Thanks you 😘

What do you think about Hive Power delegations as subscription method?

https://inleo.io/@manuphotos/hive-p2p-cambios-en-el-fee-y-nuevo-sistema-de-delegaciones-c6u?referral=manuphotos

Excelente, en un final eso nos beneficia a todos los que lo usamos, es valido el pago por su mantenimiento, es deber de todos. Asi funciona

Here is a simulation of the problem:

I can't really understand this image.

If you can explain a little bit I would be grateful. Good day to you OneAlfa..

That of 1m

I'm pretty certain it will tip to the right, but not entirely sure.. I guess that there's a mathematical solution to this, but I might just have to set up a simulation for this regardless, to see it with my own eyes.

None

Left side has a lever arm of 5 m whereas the right side has a lever arm of 5.5 m.

Somehow I managed to get

#cent 👍

Let's see that #nap can do to $HIVE #cent

Good morning what is #nap? 👍

nothing special you lay down somewhere and sleep for a short while !LOLZ

lolztoken.com

Her height is perfect.

Credit: reddit

$LOLZ on behalf of ben.haase

(2/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.@chicpunki, I sent you an

I understand haha

What happened to LeoShorts? Are you still having problems?

🚀 Keep an eye on the new #Evolution chain that has now surpassed 80k blocks and the eleventh epoch! ⛓️(Link 1 👇)

🔗 Visit our website 🇮🇹 (Link 2 👇)👀 Stay updated on #Dash @dashpay in the way you prefer!

#Platform #Web3 #OpenSource

(1) https://platform-explorer.com/ (2) https://linktr.ee/dash_italia

Good morning to everyone in threads!

I just got up and had some coffee! #gm #inleoengagement

Top of the mornign to y'ah!

Thanks thnaks and very thanks..

Good morning!

As history often repeats itself, the current market structure suggests a bullish continuation. Analysts predict that this pre-altseason phase could develop into a full-fledged altcoin rally, similar to 2017

#altcoins #cent #crypto

The market is bullish at the moment.

Do you think it could see a bearish recovery soon? $HIVE $DASH