Leveraging volatility to create stability.

HBD is a very strange asset. It's pegged to USD, but the collateral is Hive. We offer a super competitive 15% yield on it, but that yield only costs the parent network less than 2% worth of inflation to maintain (assuming zero growth). The token itself hasn't broken to the downside since before the "rebrand", and long before Hive to HBD conversions as well.

Recently many on Hive have been worried about HBD creating a bunch of inflation due to conversions. This is a fair thing to be concerned about considering the recent data, but again highlights the weirdness of the asset. We are supposed to buy low and sell high... right? Everyone knows and understands this, while at the same time telling whales they shouldn't be converting HBD into Hive at the literal bottom because it makes inflation go up on paper and creates bad optics. Let me be the first to say that this is a categorically hypocritical statement to make.

Whales holding a lot of HBD have to convert to Hive by necessity due to the complete and utter lack of liquidity in the market. This is true even if they aren't going to sell the Hive and instead opt to power it up (which doesn't move the price down at all). Should Hive implement an AMM farm to complement the internal orderbook and create exponential liquidity between the network and it's own debt? Yes, this should be obvious, and yet I see nobody championing this position other than myself. A heavy link to our own debt stabilizes both assets in the big way.

Hive Inflation for September 2024

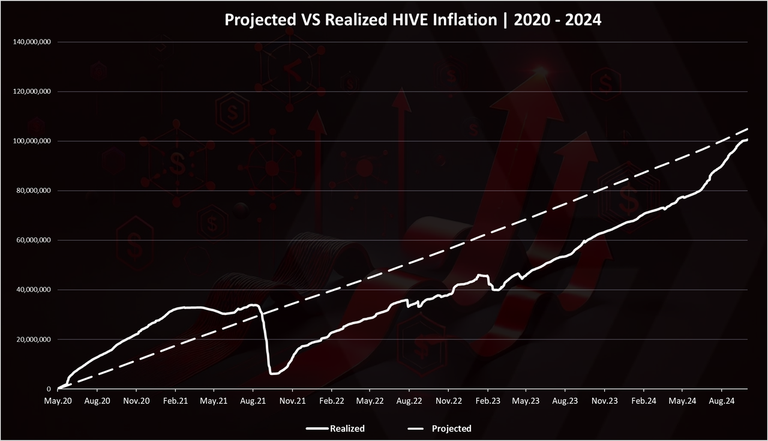

Since the creation of HIVE four years ago the realized inflation is at 100M, or on average 25M per year, while the projected inflation is at 105M. A difference in 5M less HIVE created in the four-year period. This is mostly thanks to 2021 when the year ended with negative inflation.

Stats provided by @dalz are very telling.

Over the last four years we should have produced 105M Hive, instead we created 100M. Not only is inflation doing just fine, it's coming in less than expected. It's a four year cycle, and narrowing that range to the last year and being hypercritical at the bottom is short-term hysterical thinking. Yeah 20 cent Hive is not great. But oh wait that's also exactly where we were at four years ago as well. If we want higher lows then we need to be thinking about lower highs during the good times... which again is something that literally no network even discusses because everyone blindly wants number to go up no matter the cost.

Which brings us into the flywheel.

Traditionally most assets outperform Bitcoin in the fourth year. That's 2025. We are on the precipice of greatness once again but just like always everyone has "what if this time is different anxiety". This time is not different. The displacement of institutional Bitcoin adoption is going to overflow into every other asset just like it always does. Watch what happens when BTC is trading over $100k; it's going to be chaos, as per usual.

When demand for Hive goes up: demand for HBD goes up.

When demand for HBD goes up the only way to create more is to wait for the value to hit $1.05 or higher than then start converting Hive into HBD. Something tells me that next year will be the most powerful Hive/HBD flywheel that we've ever seen... which to be fair there are only one or two examples to compare to since conversions to HBD were invented last cycle.

Looking at HBD's all time history on an aggregator like Coingecko we see something like this going back to 2020. How useful is this information? It's a little useful... but it's also extremely misleading because HBD basically has zero globally accessible markets. Today's information solely comes from UpBit and volume is around $1000 a day... which is x30 times less than orders on our own internal market. On the plus side those spikes during 2021 had a lot more volume and were a bit more accurate than they are these days.

Flywheel April & August 2021

This was the big one. Koreans tried to pump HBD and we absolutely wrecked them and took all their money using the new conversion mechanic. This was a pretty awesome stress test and it worked perfectly. Hive spiked over x4 to 80 cents over a couple of months.

The august flywheel wasn't as crazy but it still got us back to that 80 cent mark. Good to point out that both of these events were just precursors to the actual peak during Thanksgiving 2021. There's a decent chance this upcoming run could be even more pronounced with even more Hive destroyed in the process.

If you can't handle me at my worst you don't deserve me at my best.

It should be obvious that framing the current inflation situation into quarantine and looking at it without any reference to the year that balances it out is quite simply a perspective born of panic. Yes, distressed selling is not fun. Shoulda bought more Bitcoin I guess.

Speaking of Bitcoin it's going to help us create permanent demand for HBD, which should be the ultimate goal for long-term growth and continued projected deflation of the Hive token when compared to expected emissions. I'm told that VSC AMM pools that pair BTC to HBD should be launching in less than six months and that the testnet is already operational today. This is a pretty exciting development considering that Hive's greatest weakness right now is the ability to ensure expanding liquidity. Getting listings is not easy and regulatory capture of exchanges have hobbled us in a big way.

Gaming:

In theory a stable asset like HBD should be highly useful within gaming communities as well. There are many situations in which users would not want to be gambling on two different assets at once. If I'm playing poker I don't want to win $1000 only to realize that value is sitting in a volatile asset that just lost 90%. On an NFT marketplace users don't want to be constantly repricing their asset based on a volatile unit of account. HBD solves a lot of issues in these regards, and it's one of the only stablecoins out there that can't put a freeze on individual accounts.

Conclusion

The HBD flywheel on Hive isn't good or bad. This network has purposefully chosen to make the governance coin more volatile in order to have access to stable debt. There is no one-size-fits-all solution. Thus far it doesn't look like HBD creates inflation in the long run either. We are held captive by the four-year market cycle that Bitcoin creates. We can either build around this fact of life or complain about it. Perhaps next time Hive is doing quite well we'll hedge our bets like responsible adults instead of going full degen. Somehow I doubt it. This time is not different.

agree

i see a recurrent theme built around the bitcoin four year cycle

i think more and more are realizing this, as they start to believe their eyes and not the hopium on social media

i think your right

this time is not different

its just a new bunch of folks about to get wrecked ...

and hopefully a new bunch of folks who may benefit

bitcoin goes up, bitcoin gors down

money flows in, money flows out

hive goes up, hive goes down

money flows in, money flows out

if you can accumulate when its down, you look like a genius and reap the reward when it goes up

if you accumulate enough hive, you get a whole new set of friends, who help you grow your stack faster

Man you seem to drill down deep into the Hive ecosystem and know a lot about its two native tokens and the tokenomics of them. Can I ask you why is it better to convert your HBD into Hive rather than selling your HBD and then buying Hive on the open market? I hope you don't mind the nooby question, believe me I could ask a ton more but I won't irritate you!

You should never convert your assets unless you explicitly know what you are doing.

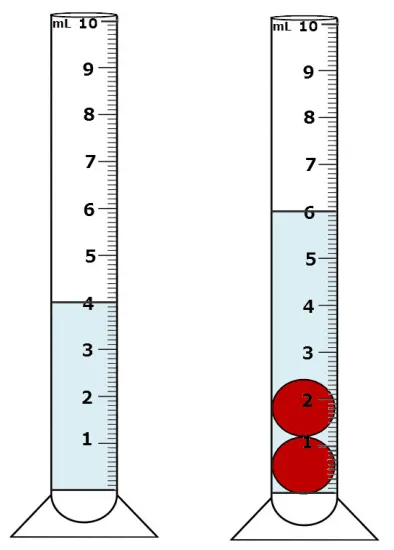

Take the current state of the orderbook for example.

If I need to buy or sell a small amount (like 1000 Hive) then there is plenty of liquidity to get what I want immediately with an internal market order. If I want to buy 100k Hive the only reasonable way to do that is conversions given this amount of liquidity. Essentially we need more liquidity, but it still works alright as is especially for more casual users.

That's fine then. So since joining Hive whenever I have enough HBD from post payouts to buy Hive I have been using the internal market and it looks like from your response for those small amounts of HBD the internal market is the best way of getting Hive, which I then power up anyway. Right?

Should be fine.

You can also choose to get paid in 100% Hive to avoid this entire process.

Ah ha! Now there's an idea, and I believe it would save me a little bit of money because each trade on the internal market takes a tiny commission doesn't it?

there is no commission but the value of HBD is often a little bit less than $1 so you're slightly overpaying for Hive. it's not that big of a deal but it can add up especially is a FOMO bull market

Yes I have noticed that. Thanks for all this information, I appreciate the responses.

Gaming is one right application of HBD. Not a gamer but dealing with fluctuating NFT tokens can most times be very boring and frustrating. It will be nice if developers can ponder on this opportunity.

Adding to that friend, what makes you very sure of a bull run soon?

2013

2017

2021

2025

2029

3033

You've got a lot of point here looking at how it has played out three times already.

Nevertheless, I am kind og creepy about this ETFguy; are they real pumpers or milkers?

Larry Fink and Blackrock?

They are selling a product.

They make more money if number goes up.

So far there is nothing nefarious going on (yet).

Numbers will have to go up with followed liquidation for them to stay in business, don't you think so?. Is this not a threat already. When big institutions like this cause outflows it will definitely show. I feel small investors will face big time loss.

Who's being liquidated in this scenario?

How can outflows result in a loss when we all bought before the funds even existed?

You're going to have to be a little more specific.

The business model of the ETF revolves around charging a yearly fee.

This is called the "expense ratio".

Currently this fee is about a quarter of a percent.

ETF providers have every reason to make number go up so they earn more money every year.

This is reassuring point that they have no reason to suppress the price, they benefit more then their customers who have skin in the game.

It's amazing how these people who build structures to allow other people take risks make money, rain or shine.

I have seen your presented facts friend. I will be making some findings for more clarity.

Hoping we don't see leveraged positions

I can see Gaming as a good use for a stablecoin.

You make some good points.

Various whales already put a ton of money in various markets with buy orders at different levels, creating resistance to price drops.

But the price still drops.

That's a ton of money it grinds through.

But, as you said, low price isn't always a bad thing.

Part of the reason Hive's prices isn't higher though I think is partially because of the following:

Yes

We are working on all those things as well.

Progress has been painfully slow

😭

HBD is definitely one thing I want to get more of but with the .20 hive prices it’s sooooo hard to try and save HBD when hive is so seductive hahaha.

The thing I’m looking forward to is having some powder for whatever happens in the price of hive. When it recently spiked up last week or the week before to like .27¢ or something I bought a bunch of HBD, knowing it was going to come back down. Sure enough it did and I made 12 hive off it. Not the biggest bags in the world but I was pretty stoked! If hive goes x10 then crashes back to x4 or 5 I’ll be happy.

It would be nice to have more consistency though and less volatility.

I'll be stacking up on HBD in 12 months for sure.

I am likewise stacking Hive due to the low price, and hoping to be in a good HP position when the inevitable bull run comes.

Solid move I think man!

Here is what is different about this cycle: the exchanges Hive is on.

Bittrex and Poloniex have closed down. Americans and Brits are banned from using Binance. And the Korean govt tightened rules on exchanges (they have to evaluate listed coins every quarter and start delisting coins deemed to be scammy or risky). The new Korean rules are the reason Hive tumbled from 30 cents in July - Koreans panic sold as wild rumours went around about which coins would be delisted.

When bitcoin pumps to $100k, all the alts listed on Coinbase and Kraken will pump. But nobody American is going to open an account on obscure minor exchanges just to buy Hive. Losing Bittrex and Poloniex was a big blow because it cut Hive off from Western money.

The solution is to get Hive listed on Coinbase or Kraken asap...

Or get VSC AMM pools operational.

Agreed!

Some good observations here but I'm not sure the exchange issue is the reason Hive dropped in value in July. Virtually all of the alts took a significant hit at that time.

However, what does seem irregular this time in the cycle is the Bitcoin to alt coin price ratio, it seems a bit out to me. Let's not forget BTC has been trading not that far from its ATH pretty firmly for the past few months, yet the alts have taken a huge hit. I'm not sure it was the same type of BTC to alt coin price ratio this time in 2020.

I don't know if @edicted has any thoughts on this?

Don't forget we have our own DEX to trade Hive on called LEODEX.

If enough of us use it the bugs will get fixed and we might even get a trading pair betweek Hive and Cacao. As it stands we can trade Hive for Bitcoin, Ether or USDC via LEODEX. So Americans and Brits have a place to go.

#khaleelkazi has plenty of posts on it, as do I.

By my estimates, HBD interest is costing around $100k per month and the peg another $100k to maintain. According to Dalz, $21M HBD cumulative has been spent maintaining the peg since Nov21, thats quite big compared to the current market cap. I do wonder if it would have been better to back HBD with short term US treasuries instead of Hive as this would bring real fiat cashflows into the Hive ecosystem.

I don't really see this as an option because it opens us to counterparty risk and completely centralizes the asset while giving power to an outside entity. We can get the same effect by simply lowering the interest rate at the top and forcing yield farmers to go find something else; that something else could indeed be bonds.

If we want support at the bottom we need one of two things:

This is yet another reason why everyone on Hive should have a shit-ton of Bitcoin.

Just easier to ride the coattails of the big dog.

Only takes a tiny amount of BTC to make a huge splash on Hive.

Makes sense, next year is going to be super interesting.

I cant help think the Tether business model is so successful, they basically just get free yield for producing digital assets that pay no yield.

It's been a little weird to see HBD not as close to 1 as usual lately.

Sure what what are you seeing HBD at these days?

A lot of the time coingecko will say it's 95 cents when it's actually more like 99.7 cents on the internal market.

Yeah, that must be what I am seeing then. Right now it is showing around $.95 which to me feels low if it is supposed to be pegged at $1.

yeah it's basically impossible for it to be 95 cents without the haircut coming into play... and the haircut can't come into play unless Hive is trading at like 4 cents or some shit. not gonna happen

Okay, gotcha! I guess I should have dug a little deeper myself.

Have you looked at the HBD websites?

https://hive.ausbit.dev/hbd

https://hbdstats.com/

Nope, never.

I really like the premise of what the LEO Finance guys were doing with HBD being tokenized on the BSC but I don't know what ultimately happened to their bridge.

Ultimately I wish HBD could get on a couple more exchanges and with the premise of more DeFi opportunities to bring more value to the whole ecosystem it is a big positive!

But this desire to see Hive and HBD on more exchanges is one of the core reasons behind the leo-cacaoswap listing.Sorry, I know this question is for @edicted '

That wrapped Hive token , i.e. Arbetrum Leo ties us to swaps on cacaoswap and that also gives us access to Thorswap.

So Leodex conveniently does all the swaps for you to allow you to swap your Hive for Bitcoin, Ether and USDC if you wish.

The next step is to add HBD to the mix, but right now, when I attach my Hive Keychain wallet to cacaoswap I see only Hive and Leo.

Perhaps @edicted has traded HBD for Bitcoin or Ether on Leodex, I haven't tried it yet.

Eventually @khaleelkazi would like a trading pair between Hive and cacao and possible HBD and Cacao, but the Hive community would need to give the founders of Cacaoswap a reason to add our tokens, we need to provide lots of trading volume.

To be honest, I thought the ability to trade Hive for Bitcoin on a DEX would be a huge attraction for Hivers, but so far I don't think it's a huge volume trade yet.

Not enough people probably know about it. I remember the whole Cacao thing being talked about but I have never used it. I used to use Cub Finance and also HIVE Engine to get out. We really need that huge influx of people to come back / start new accounts to kick up the volumes in a big way but we all know it takes good price action for all that to happen. Chick before the egg type thing.

True, we need volume and we need liquidity providers to make things work well.

I provided liquidity on Tribaldex for leo-Hive pool and liquidity on cacaoswap for cacao-leo pair. It only requires a little liquidity, 100$ or 1000$ if you can lock up that much.

Eventually the pair will payoff in leo, which you can power up or trade for Hive. My assets are lopsidely Leo, so I am balancing things out while Hive is cheap.

I hope more people hear about LeoDex in the coming months

HBD and hive have a great thing, it is that we are able to see what is happening and take control before it goes too far, and we have the haircut rule which can help a lot to stabilize everything before it's going to far too.

There is still something I'm thinking related to the interest given to us when saving HBD, 15% is still a lot, I would say 10-12% would be good, even when we now have a balance, we are giving a lot of funds when a 10-12% for a stable coin related to the $ at any time, is still pretty good anywhere

Has it before?

The discussion of volatile Hive and stable HBD reminds me that I realized if US dollars continue their expedited inflation, if Hive remains stable in price of real goods, then sooner or later Hive will be more valuable than HBD. How will this affect us?

Thanks!

There's a big big BIG difference between USD becoming volatile, and USD going down more quickly in a completely stable fashion. High inflation can easily be offset by increased yield, while high volatility can not. Luckily it is extremely unlikely that USD becomes volatile.

HBD is just a derivative asset; how we use and what it's pegged to it is up to us. I've been theory crafting an idea where the derivative asset is actually a volatility token whose purpose is to stabilize the primary asset. Prime asset price is too high? Dilute it by burning the volatility token to create more asset. Prime asset too low? Sacrifice the volatility token to burn governance tokens from the liquidity pool. I would not be surprised if this became standard practice in the future for any coin looking to stabilize their volatility by creating these types of elasticity.

USD have declined in value more than 99% since the 19th Century. They don't have to become volatile for dollar pegged HBD to decline in value below the current worth of Hive tokens.

That's a very good idea about stabilizing a Prime asset token.

!PIZZA

The Hive.Pizza team manually curated this post.

$PIZZA slices delivered:

(4/10) @danzocal tipped @edicted

Learn more at https://hive.pizza.