Paying my rent with HUAHUA.

I've been doing a bit of a thought experiment lately, and figured I'd spell it out in a post and see what people think. As some followers may be aware, I am currently full time crypto, and supporting my family from savings and crypto income. So, I've been thinking the last few days, how much risk I should be prepared to take chasing income.

Enter HUAHUA.

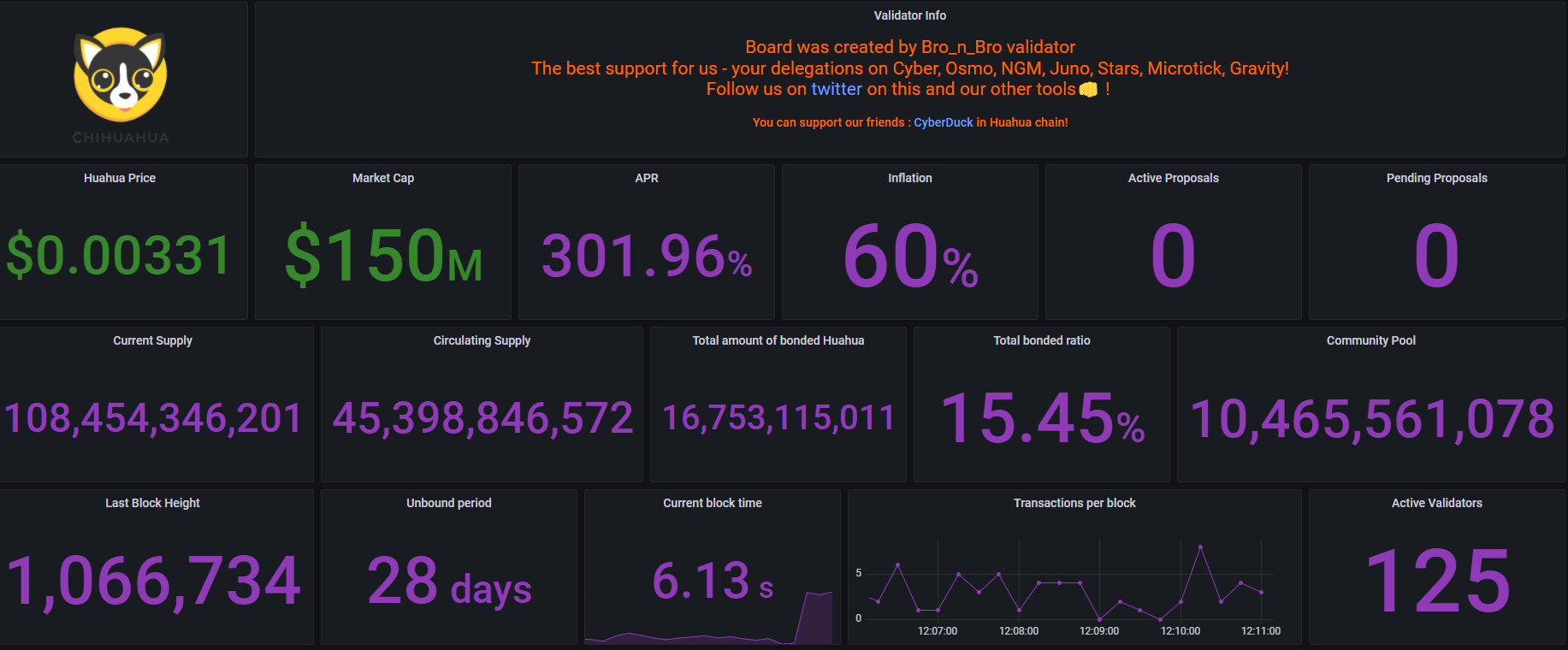

HUAHUA is a meme coin launched into the Cosmos ecosystem via airdrops a couple of month ago. It currently has a market cap of around $150 million according to the Bro_n_bro dashboard. A high staking return currently at 300% APR, and $12 million of available liquidity on Osmosis, where HUAHUA pools also earn a high APR and dual rewards in both OSMO and HUAHUA.

The price has been relatively stable lately, hovering around $0.003 each. This has me thinking, how much HUAHUA would I need to pay my rent from staking returns?

So, lets work it out.

- Currently, I pay $490 AUD per week in rent.

- Converted, this is approximately $355 USD per week.

- That work out at $18,460 USD annually.

- Earning 300% APR, I'd need $6150 worth of HUAHUA (assuming no change in APR or price)

- At current prices, that is 1.86 million HUAHUA.

To have a buffer Zone for safety and to allow for reducing APR over time (which is inevitable), I really would consider 2.5 - 3 million a more realistic number. That is nearly $10,000 USD.

So the question then becomes, can I justify risking 10% of my crypto assets on a Meme coin?

What does everyone else think? Could a position like this be considered a smart move? Or foolish and irresponsible? I am in a position, with some OSMO LP positions unlocking, to actually seriously consider making this move. The question is, should I?

Thanks for reading, let me know what you think.

Cheers,

JK.

Check out these posts while you are here:

Posted Using LeoFinance Beta

Maybe I'm missing a meme coin opportunity honestly but I go for the OSMO-SCRT pool (at 100% APR at the moment) without hesitation :D

I might throw my tomorrow dividends in HUAHUA-OSMO because of you tho ;)

Posted Using LeoFinance Beta

The funds are coming up due to a consolidation of a few smaller pools I am dropping out of. HUAHUA is a bit of fun, and I never really had any Doge or Shiba. I don't really think I could commit that much, but am DCAing small buys each day and compounding earnings.

HUAHUA/OSMO earns high yield, good OSMO income plus a chunk of HUAHUA each day as well. Combining OSMO and HUAHUA rewards, it is well over 200% APR.

Posted Using LeoFinance Beta

Yes I wanted to ask you about the 300% APR displayed on bronbro dashboard.

Was thinking the 140% from the pool + the liquid HUAHUA incentives would add up but couldn't reach 300%.

Posted Using LeoFinance Beta

That 300% on the dashboard is the staking return. The pool return is a different thing. Each fortnight (I think it is) the pool rewards get updated via governance and a "semi-automatic" adjustment.

Here is the most recent doc that shows the OSMO and external APR's for every pool.

link to doc

If you scroll down, the most recent APR calculations show that the external ARP (HUAHUA rewards) in the pool are around 140%, and the OSMO rewards are similar. I think there are some dashboards on the way to make finding this info easier, but for now checking the most recent governance proposal is how I'm keeping an eye on things.

Posted Using LeoFinance Beta

I'm discovering this spreadsheet definitely too late !

Thanks a lot for the link.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Surely those yields and token value isn't sustainable?

I'd be continuing to build a larger stake in more sustainable tokens and LPs.

You will need a bigger investment to hit your weekly rent, but it has to be sustainable.

Posted Using LeoFinance Beta

Yeah, the yield dilution is undoubtedly the big risk. If it wasn't such a significant portion of my capital, I'd possibly think seriously about that sized investment, more so as a source of funds to compound into more sustainable projects.

On the flip side, I'm trying to work out how to cover my living expenses without selling any capital, so chasing high yield is appealing.

I'm not likely to pursue this path, but just looking at all options to cover the cost of living without selling capital.

Thanks for the wise input mate.

Posted Using LeoFinance Beta

If you were swinging for the fences on a play where you could afford to lose 10% of your stack for potential 10000x gains... I would say, know the risks... and go for it. Since you are trying to pay the bills with this, I would say you are better of staking ATOM/COSMO as it is high yield and pretty safe.

Definitely the LP's on OSMO are the main focus. This strategy is high risk, no doubt. Wiser to accumulate my way to a big stake than buy all at once. But, its on the table as I'd rather be able to cover all my expenses from income (and have some left over to compound) than sell capital to stay afloat.

Just thinking of ways to avoid having to look for a new fiat job really.

Thanks for the input.

Posted Using LeoFinance Beta

Ya, I am looking for these options too. (To quit my job). My long term perspective... chasing APR's isn't sustainable, but if you can chase APR's for the next while well the getting is still good, you can amass enough to be able to stay afloat while APR's inevitably drop. Ultimately, getting to that magic level (say 1 million, as you could live well off of interest alone on that (even if APR's settle at 8%) is the key for me.

That said, I moved my rewarded OSMO into Huahua as you are onto something. Granted, that was $20, not $50K.

I am not incredibly sure how long the APR will hold up at that rate to sustain paying your rent. Although I think it’s the best meme coin out there, running a validator node will make you bias, lol. But it’s a risky play for sure. Hope you find the answer you are seeking, lol. Good luck!

It seems that Leo advice is fairly cautious. Risking a big chunk of my funds on a meme coin is not a serious consideration. But I am asking myself if HUAHUA really is just a useless meme, or if it is more substantial than it makes itself out to be, and worthy of consideration.

Definitely not my main focus, but it was an interesting thought experiment.

Posted Using LeoFinance Beta

Every ecosystem needs a good meme, lol

I'm currently sitting on ~4M tokens. The yield from it is quite insane and I'm well in the green from where I bought / the 1M I got from the initial airdrop. I'd honestly say go for it; in all honesty, it seems to be a rather reasonable level of risk for the potential upside.

And trust me, I absolutely hate memecoins too; this one has just played out SO differently compared to other memecoins. Plus, the staking yields just make it absolutely insane.

4M is a really nice stash, earning 300% APR. Gives nice funds every day to put into other things, while the price holds up.

I think I'll just accumulate it a bit faster, rather than buying a big chunk at once.

Bigger fish to fry with building positions on Osmo, Juno, CMDX, and soon Evmos as the main priorities.

Posted Using LeoFinance Beta

4M is honestly more than I want to have lol, but yeah, I've been swapping the daily yield over into ATOM / JUNO / CMDX / UST for opportunities to buy dips.

I think aiming for enough to pay the daily rent is more than enough, especially if you're compounding daily.

Evmos is going to be very interesting - we're aiming to validate that one too (although we won't be in the genesis set).

Another potential one to catch (comparable to $HUAHUA most likely) will be $CRBRUS (Cerberus). Goes live on 3/15, and there's a big airdrop coming (71% of entire supply) to $HUAHUA / $ATOM / $OSMO stakers, I believe.

Might be a 2nd chance to catch a memecoin with high yield right at the beginning / on the cheap. We'll be a genesis validator there as well.

Plus #HANSUM also - all of the Meme coins. Just posted about JUNO, really can't keep up with everything going on.

Posted Using LeoFinance Beta

4M is honestly more than I want to have lol, but yeah, I've been swapping the daily yield over into ATOM / JUNO / CMDX / UST for opportunities to buy dips.

I think aiming for enough to pay the daily rent is more than enough, especially if you're compounding daily.

Evmos is going to be very interesting - we're aiming to validate that one too (although we won't be in the genesis set).

Another potential one to catch (comparable to $HUAHUA most likely) will be $CRBRUS (Cerberus). Goes live on 3/15, and there's a big airdrop coming (71% of entire supply) to $HUAHUA / $ATOM / $OSMO stakers, I believe.

Might be a 2nd chance to catch a memecoin with high yield right at the beginning / on the cheap. We'll be a genesis validator there as well.

I'm currently sitting on ~4M tokens. The yield from it is quite insane and I'm well in the green from where I bought / the 1M I got from the initial airdrop. I'd honestly say go for it; in all honesty, it seems to be a rather reasonable level of risk for the potential upside.

And trust me, I absolutely hate memecoins too; this one has just played out SO differently compared to other memecoins. Plus, the staking yields just make it absolutely insane.

I will always like to take back my initial capital instead of going more in "meme" culture.

But going in for 2-3% of your crypto portfolio can be sane choice.

Posted Using LeoFinance Beta

Yeah, a few percent would be an acceptable risk level. I don't really see commiting 10% as smart, but then HUAHUA is not just another useless meme, it feels a bit better than that.

Anyway, thanks for the input.

Posted Using LeoFinance Beta

If you really want to do it, I'd go half. At most. 10% of your stake seems like too much. That's a pretty large chunk to overcome if it goes upside down. 5%, while still a good chunk, seems more reasonable to put on something so speculative. If it works, you're halfway there on one investment with the opportunity to make up the other half with the other 95%. If it doesn't work...well, going up or down $5k in value with our portfolios seems to happen on a weekly basis these days. lol It just seems a much more reasonable number to overcome.

That said, the biggest factor may very well be just limiting your downside. If you can put a plan in place to make sure you don't take the full 10k haircut if things go south, then maybe you can do it all. The problem with that is that with something at such a low value, it doesn't have to move very far to change the numbers in a big way.

We can just go with the cliches:

"Go Big or Go Home!"

and...

"Fortune favors the Bold!"

and all that.

Of course there's the old standby:

"Pigs get fat, Hogs get slaughtered." lol

The real question I think has to be, are you going to be more upset if it works and you didn't do it? Or if you do it and it doesn't work?

I've got a couple things I didn't do that could have made me a fortune and it doesn't bother me a bit. Sure it would have been nice but the risk would have eaten me alive.

On the flip-side, I've done a couple things that didn't work like I'd hoped and they tend to bother me a little more. So, for me, like I said above, I might do something here, but I definitely wouldn't do the full amount.

Just my thoughts. Whatever you decide, I'll be interested to see how it turns out. Good luck!

Posted Using LeoFinance Beta

It is an interesting thought process, and the cliches are appropriate. It's definitely not the only option, and safer ones will work. But it would mean that I could compound more effectively the safer options, to grow them also in the long run.

Might accumulate to that level over time, rather than risk funds intended for other things in one hit. A DCA, plus compounding option might be the best approach.

Thanks for the detailed input, much appreciated.

Posted Using LeoFinance Beta

Can we view HuaHua as cosmos dogecoins or shibcoins?

Posted Using LeoFinance Beta

Yes, generally. I think it is a bit better, and with my assets focused in the Cosmos, much more accessible for me. It has a solid community, good validators and a fun atmosphere around it. No idea if it can hold value in the face of massive staking returns, so definitely high risk.

Posted Using LeoFinance Beta

10% of your holdings? If you weren't living off your crypto (which is very impressive by the way) I'd say it's a reasonable amount to risk. But, realistically, I wouldn't feel comfortable given you need the income. I think there are better projects out there to generate income from.

Posted Using LeoFinance Beta

Just at the start of living off crypto really, and not exactly how it was planned. But I think I can make it work, just need to balance the risk profile and find ways to avoid selling my initial capital. I think better to focus on the more secure projects, and keep this as a fun one. DCA, plus compound and see what happens, rather than rely on it.

Thanks for the input.

Posted Using LeoFinance Beta

I'm looking at ways to improve my passive income via crypto as well and just set up a farm on CubDefi actually.

What's your favourite passive income source at the moment?

I got into AKT back when you were doing that but moved everything out a little while back. I did OK there but the recent dip essentially killed any profit.

Now I'm more interested in generating income streams rather than relying solely on growth.

Posted Using LeoFinance Beta

Favourite passive income currently is Osmosis LP's, for sure. UST/OSMO limits both the risk and the upside, as the stable pairing provides stability. Most of the Cosmos assets are fairly price co-related, so IL isn't a huge consideration. ATOM/OSMO, LUNA/OSMO, and a few other pairs are all in my long term plans.

I just dropped a new post, about JUNO. Worth a look for another place to build income.

AKT has been disappointing tbh. I still have a bag, but some founder and VC unlocks have really hurt it. There is another unlock in march, so I'm not bullish short term. But they do have some new things on the horizon that could turn it around.

Posted Using LeoFinance Beta

Personally I'll keep avoiding meme coins. I sold my HUAHUA airdrop. But if they hold their price and APR, it could be an option, if that's what you want. It will make you a rich man if it goes ballistic as DOGE did.