I have updated my witness parameters to signal for 20% HBD interest. Previously I was signalling for 12% interest.

There have been discussions about increasing the HBD interest for a little while. One of the witnesses suggested it may be a good time to push for 20%, and I agree.

While I am only one vote and alone will not change the current interest rate, I am signalling for 20% interest for HBD, making HBD one of the most attractive options in the crypto space.

Currently the interest rate is 12% and it will remain so until the majority push for different interest rate. There has been pretty solid support for this change so I expect to see other witnesses do the same although full support may not happen for a while if ever.

There is some concern this may compete with locking up Hive (long term, 13 weeks) which typically results in around 8% curation rewards plus 2.8% vesting interest. Locking up HBD is only a 3 day commitment.

I believe most people who take advantage of HBD interest will also have Hive powered up. While the ratio may change with an increased interest rate for HBD, I am not concerned. As more people power down, powering up will become more attrac While 20% HBD interest may seem more attractive, you miss out from any potential runs (in either direction) Hive may have. This may be good or bad depending on where the Hive price goes.

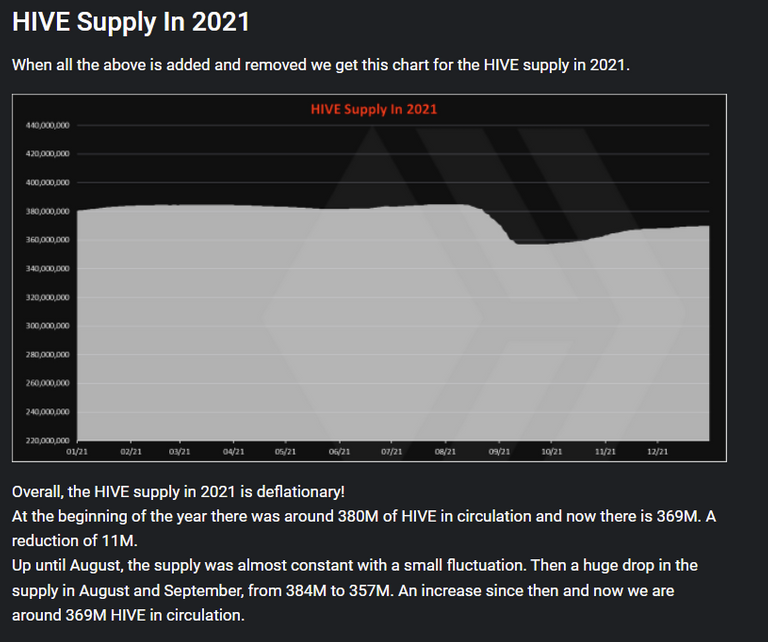

Every since @smooth introduce the HBD Stabilizer, Hive has had some really solid economics and support. It has also resulted in locking up millions of Hive to be used for projects to improve the Hive platform. It has worked so well in fact, we have had deflationary periods in the the last year. This the also the result of the massive amount of Hive burned by @splinterlands creating accounts.

Source: @dalz

I believe this change will make Hive very attractive to other options. Pair this with some marketing and promotion discussed by other witnesses, this could be a game changer for Hive.

Posted Using LeoFinance Beta

I agree with the 20% interest rate. It is clear that there is very significant demand chasing relatively low risk yield in stables and 20% would put us at the top of the competition with the likes of UST.

In terms of locking up HBD over Powering up, I think I agree with you that the attractiveness of HBD may actually cause people to buy HIVE in order to convert it to HBD for lack of any real venues outside of Korea where liquidity is ample. I do think that there are probably some debates needed on whether the 5% fee to burn HIVE for HBD is on the higher side, as I imagine that is going to be the main method of obtaining a more substantial amount of HBD. Of course, an increase in the market cap of HIVE triggered by this will allow for more HBD to be printed with the current debt cap, and I am aware of discussions to also raise this, but I still believe the 5% fee for conversion leans on the higher side.

I also think it's pertinent to debate a potential rebranding of HBD to something that resembles "USD" a little more. It's such a small thing but I feel as though people feel less secure with things like DAI and HBD as opposed to UST, USDT, USDC simply because of the (un)familiar nomenclature to outsiders.

Rebranding is intersting idea ... USDH, USH :)

We'd have to decide if we are really committed to USD or not. In the past there was some discussion that the charter is really stable value and if USD deteriorated sufficiently we could switch to something else like a basket of commodities (I'd argue it should still programmatically inflate modestly, say 2%/y). In that case putting too much 'USD' in the name wouldn't make sense.

But on the other hand we could fully commit to USD and if USD really went bad we could create another coin (significant/infeasible development effort to do today at base level, but maybe someday).

On the other hand, I guess if the target changed the name could change again too.

I feel uneasy about making too many or too large steps at once but I think modestly altering the name could be a small first step - just to re-orient people's perception of HBD. Of course I also don't know how much material difference it would make as I am simply going by my own "would be" initial impression of HBD, and that is, it is not as strong as a brand as something like USDH which might immediately give people a little more confidence.

USHD

US Hive Dollar

Posted Using LeoFinance Beta

USDH is a great idea, jumping into the attention corridor of USDT and USDC

Perhaps HUSD - Hive USD another option.

Yea that one is good, I just think Huobi got it allredy ... almost 1B in marketcap :)

Overall printing HBD should be considered as an act of balance from the witnesses.... with the main thing to consider the Hive debt.

At the moment HBD is in a great position with around 2% debt. Hive has been conservative in this regards for a long time. With the increase of the haircut limit in the next HF there will be even more safe room.

At some point if we get above 20% debt, probably will be a good time to reconsider the hbd apr.

That has to be balanced with growth. If there are enough use cases forming for HBD and the token is being circulated, creating a thriving economy, then the debt level will not be a problem.

Obviously, if that takes place, the amount of HBD required will be enormous, meaning the demand for HIVE will increase.

As always, it comes down to building. If project teams are doing that and incorporating HBD in, then growth will offset it all. This is where I believe the foundation of Hive differs from many: we have builders here.

Posted Using LeoFinance Beta

I know there is at least one dApp that will be locking up a lot of HBD.

Posted Using LeoFinance Beta

It is a perfect solution for gaming.

Lock up some HBD in savings, earn 20%, and use the proceeds to fund some of the #Play2Earn. As popularity is achieved, and people are buying more NFTs, skins, or whatever, that money keeps getting pumped into the savings.

As it grows, so do the payouts to the players. A rather simple revenue source for the game.

Only 1? LOL

Posted Using LeoFinance Beta

There may be more than one, I just know of one. I am actually thinking about using for my projects as well. It isn't easy though, because you don't get the 20% instantly and not many people want to wait a year to get it. It also comes locked up so you are constantly unlocking rewards.

Being monthly, that means that is the shortest term you can use it for your dApp users without dipping into your own pocket.

In fact, it is likely you will have to dip into your pockets to use the rewards for a dapp which becomes a nightmare in terms of calculating. For example, if you wanted to use HBD to support a weekly reward pool. That's about 0.38% gain weekly if you ignore the 3 day to unlock.

Posted Using LeoFinance Beta

Just draw from principal. The interest will replenish it at the end of the month when paid. The interest will be slightly lower of course, but not significant.

One risk is that witnesses reduce APR (potentially to zero) before it gets paid out. This should be made clear in the rules of the game/dapp.

That is all true. At best you will have to wait a month to get the first payout and build from there. You are right, the accounting could get rather wonky if not careful. Have to first develop some type of revenue stream then place it in the savings and start earning there.

Alas, first order of business is getting the option there for people.

Posted Using LeoFinance Beta

I pitched the idea earlier to @smooth as well - we definitely need a good marketing and promotion for HBD to bring in people to invest for stable returns.

I'd like to mention my view here, and why I'm still voting for 7%. There are a few reasons for me being "conservative". HBD is a debt, and one way I like to view it is that it is like a bond – it provides current liquidity at the cost of future payment. Interest rates on a bond are typically represented by the risk (of default, or lessened payments) associated with said bond.

Do you think Hive is currently a risky ecosystem? Presently, I do not.

The choice rate is a magic number regardless, as there is not a scientific process to determine a correct number. It is hard to anchor it to anything other than to related projects, or to the backing itself, the USD. Other DeFi stablecoins we might compare to can have extraordinarily high risks. It cannot be a perfect comparison for interest rate because the fundamental systems are different, and thus so should be investor risk tolerance.

Compared to the USD, Series I Savings Bonds are currently at 7%. This in my mind is a good relative comparison for stability in USD. The average stock market rate of returns is also often quoted being between 7-10%, which is a good comparison for growth rate. So, I feel comfortable with my choice of magic number for now.

The second reason I haven’t changed is precisely because it is not necessary for all the witnesses to use the same number. Having different beliefs and presenting that in voting is a feature, we do not need all witnesses to tow the line to determine this number, since it takes the median. Better, it shows other projects and the community that the witnesses can have different opinions, which projects diversity and decentralization.

I’m perfectly happy with the rate being higher as a sort of promotional plan or marketing, and the ecosystem is certainly well equipped to absorb a higher debt presently. However, since we do not need all witnesses on board, and I have (at least in my own mind) good reasons to suggest a lower rate -- I am happy to be an out-voted counter-opinion.

What is MEDIAN?

You're the first person I have seen in today's articles about HBD to mention the word "MEDIAN" which is clearly indicated on the Witness page as the mathematical method used to calculate the HBD interest rate.

For those who want a definition of MEDIAN, you can go to https://byjus.com/maths/mean-median-mode/ and see that

So if we have this list: 1 3 4 7 7 8 9

the Median value is the middle value, which is the first 7, so the Median is 7.

I assume this is how the HIVE code calculates the interest rate - by ordering the witness's signaled interest rates from low to high and then picking the middle value.

In top 20 right now

Then the HBD APR will go up to 15% or 20% any way :)

Really a big consider to put more HBD for staking now

Posted Using LeoFinance Beta

Thanks for the comment!

I was just playing around with the Spreadsheet I created for this post: https://leofinance.io/@kenny-crane/how-hbd-interest-is-calculated-with-spreadsheet

And I realized that if ANY Witness who's HBD Interest parameter is 12 or under switches it to 15, then the HBD interest will become 15%.

AND NOW I see that someone did, so we are now at 15%!!!

https://peakd.com/me/witnesses

Posted Using LeoFinance Beta

Correct

Thanks! 👍

20% is definitely competitive, especially for a blockchain that has been around as long as Hive. I saw yield of 20%+ about 6 months ago for other decent/respectable platforms, but nothing much over 14% recently unless you want to risk liquidity pools for dodgy assets or maybe do full KYC.

I was wondering if I should make an investment into Hive, maybe I'll make it into HBD instead if this 20% pulls through.

Thank you for this update of your witness' APR setting. Hope to see enough witnesses switch to it, to make it effective.

As for the competition between staked HIVE and HBD for the best APR, yes, there will be some moves from HP to HBD in savings if that happens. But at the same time, whoever wants to have a say in governance, proposals and curation will keep HP. And if some HP will end up in HBD savings, that means the curation rewards should increase for the remaining curators, increasing the attractiveness of holding HP and using it.

Thanks for the update. I have actually made a habit of checking the witness page about once a week to see who has the interest rate set where. 12% is already incredibly attractive. 20% will be even more so. At 20% HDB can compete against some of Defi, and HBD has the huge advantage of being stable and much more trustworthy.

Yes, I suppose it may soak up some of the money that people would otherwise use to power-up. But, then again, I think many of the tokens and the diesel pools (some of them have just insane APRs, like the PLN one) are already soaking up that money. It's likely the HBD savings takes money people would throw at tokens and pools more than money they would use to power-up.

Another huge advantage is a 20% rate could attract outside interest. It may attract new people to join Hive just so they can take advantage of that rate. Then while they are taking advantage of that, they may look around Hive and decide they like it. That's be a huge win if we can attract new people!

Anyway, thanks Marky for the update. I hope other witnesses follow suit.

In regards to the concerns about the governance.

You might think this change may result in users powering down and buying more HBD. Which is true and real.

In this case, the HBD price goes up. When it goes over $1.05, buying HBD is not worth it anymore. So the conversions start to happen. HIVE to HBD. This results in the deflation of the liquid HIVE in circulation.

So as long as this goes on, we burn HIVE day by day, and the liquid HIVE is getting less and less in the circulation. There might not be any governance concerns because most likely the proportion of HP to liquid HIVE won't change that much.

This change with enough marketing power can result in higher prices for HIVE. And since HBD is stable, we won't have any over-printing issues like the old chain.

And this is not a pure financial change. It's mostly a marketing move.

A good move. This is something that is needed. We have a very low distribution and HBD and it is impossible to have a serious stablecoin with 9 million actually out there.

Adding in a time lock feature would really help. This was the idea behind Hive Savings Bonds. Nevertheless, since we need the HBD having the extra interest is appealing.

We also have pHBD on its way. This is something that is going to help the entire ecosystem. Set off some compeittion.

HBD is very low risk on chain. A strong 20% with minimal risk is hard to beat.

I hope others follow the lead.

Posted Using LeoFinance Beta

One other question does this 20% to HBDs on savings go on being printed when the Haircut rule comes into play and HBD stops getting paid out as rewards?

Interest isn't affected by haircut but if conditions called for it witnesses could consider changing the rate including to zero. That might or might not be a good idea since it would reduce supply but could also discourage people from holding their HBD and make it harder to recover.

Cheers, if we were going to vary the 20% in any way it would need to be VERY clear I think under what conditions it can vary, easier to just keep it the same!

It can vary under any conditions. It is not a "promised" rate. This should always be made clear.

I wonder what the implications are of this for attracting new investors... It's an interesting stable coin HBD, that's for sure!

What @smooth said

This sounds like a great idea to me. If we want HIVE to become mainstream, we've got to do some things that make it too good to ignore. We've already got the fastest, most decentralized blockchain in existence, in my opinion. This just adds another arrow in a quiver already full of them.

While I think the true explosion in HIVE is still a few months away, I do believe it is coming, and having a stablecoin paying 20% will add a major benefit to anyone looking to get involved in the ecosystem.

Because of this, I just added @smooth.witness to my witness votes bringing him very close to cracking the top 20.

Question:

Where does the extra HBD come from?

Is it just new money added to the supply or is it taken from other funds already being minted?

Its a new inflation, has been around 30k HBD per month in the last few months .... if we add this to the around 2M HIVE inflation atm its extremly low, aditional inflation for now :)

It is a new form of inflation.

Posted Using LeoFinance Beta

I thought so - but quite insignificant ATM right with the HBD value being only around 6% of Hive (TMC) - so 20% of 6% = not much of an addition for quite a lot of publicity gain I think.

Its less then 1% aditianal inflation.... around 0.1% ... hbd in circulation is around 9.5M and around 3M is in savings

https://hive.ausbit.dev/hbd

I went with this - I guess this includes the DAO... I'm talking worst case sceanrio, I get yer point though - use the figures IN SAVINGS!

DAO can't get interest because it can't go into savings.

Yea that includes the dao that is now at around 15M ... debt calculations excludes it

Great question Revise. I would like to know about it as well.

Posted Using LeoFinance Beta

20% would be lovely and I agree with all the positives mentioned in your post but my question is simply this;

Obviously people would be looking to buy tons of HBD on the open markets, how difficult would it then be to hold the peg at $1 and not let the price rocket out of control?

The stabilizer should be able to push it down. If the price goes over $1, the stabilizer will use the HBD to buy Hive and send it the DHF.

Posted Using LeoFinance Beta

If you and Smooth are confident of that then it should be a genuine game changer for Hive, especially as this ought to generate a lot of positive publicity.

Appreciate you taking the time. Thank you :-)

20% is really high but I won't say no to it.

Crypto.com has reduced their rates drastically and I have funds looking for a high interest home.

If I signal 20% too do I have a conflict of interest?

I've seen a lot of talk on Reddit about crypto.com reducing their rates.

As a witness, it is your job to signal what you think is right. No one party has enough power to swing the vote in their favor to benefit from it.

Posted Using LeoFinance Beta

Seems like Binance is the only exchange with enough volume to support transferring six figure sums from Crypto.com to HBD.

Am I missing another method that can handle this sort of volume?

I believe that's it.

Thanks for your opinion on this as a witness. 20% would be great and I suppose it would result in more HBD locked in, even by those who are transferring every cent out to exchanges.

Both have their advantages and a I say keeping a healthy balance between HBD in savings and HIVE staked is the answer.

Posted Using LeoFinance Beta

How would it be sustainable? Would not everybody just dump there HBD?

Sorry im not 100% into the economics of hive and hbd. But like tera they needed a lot of money to topping up there treasury.

If you have some good links and infos for HBD, i would appreciate it.

Terra is a bit different because they have a fixed treasury that came from a premine. Hive is inflationary by design.

Arbitrarily high interest paid on arbitrarily high savings would not be sustainable, but this isn't that.

And terra is kind of abusive from top holders. They start buy other cryptos in billions.

I would not wonder if they bust luna with it.

It's a little sketchy but supposedly a foundation that will benefit the chain. We will see.

I like the decentralized model better in most cases. For example, we could also buy other assets to serve as secondary backing/stabilizing, but it would have to be a proposal approved through DHF, with suitable safeguards (multisig, limited budget, etc.). A foundation basically run by one guy, eh, could work, but...

I agree. But that's more theory.

If the chain itself could control wallets, yes that would be good. But I don't know any way this could work. And if billions are controlled by a group of people, I mean, we are in crypto and know it better.

I think Luna Itself will blow up to an unstable tether version. So if big enough, it could start hammering things to zero ( not zero, but damage the market).

If peg from TUSD should not hold, we see panic.

If peg holds and bear market happens, Luna dies because of inflation.

I mean we know it better from hive.

We could know all agree nobody sells up hive hits 100$.

creating a bazillion HBD ( + 20% hype).

creating protocols/pools for trading HBD to other stable coins, supporting the peg with DAO fund.

At some point, funds are not enough to support the peg and it breaks.

I think this happens to terra this cycle.

Btw, do you know a way to short it without risking the collateral? :D

That may be the goal. After all, Tether has been very successful.

sure I think so too.

The problem I see is the unstable part. USDT has now a MC of 16,7B. If this shit starts winning like wave stablecoin, I'm really sure we see panic.

And the bigger it becomes, the bigger becomes the risk.

if some % comes into xxx- Millions of Dollar, we see the ponzi will break :D

I mean its the best magic trick ever.

Boost your coin, make a algo stable coin on it and start pushing the price with your printed dollars.

print more dollars and exit scam into other cryptos :D

It is an additional inflation to the normal Hive inflation. In theory they could dump their HBD much like they can now. Also in theory, many may buy it to take advantage of it.

If it doesn't work out, it can easily be scaled back. It is a witness parameter and requires no changes to the blockchain, witnesses just change their parameters.

Posted Using LeoFinance Beta

In general I see that as a gamble, we might attract people to buy HIVE to convert to HBD. HIVE price might go up. In this case holding HP and HIVE in general might be even more profitable, hence I can see no danger in said competition.

While this group of people will dump HIVE as soon as they'll find the greener pasture, the spike in price might attract another group of people interested in blogging on HIVE. There is direct correlation between price and activity and there seems to be some threshold of earning which attracts masses.

The other side of the gamble is making governance model more vulnarable, however at this point it seems to be far fetched do I'm in favor of bringing 20% APR on HBD. You have my vote!

Sounds awesome.

If we just focus on onboarding and if the HIVE price stabilizes then I think it'll work wonders for HIVE block chain. We might see people come for 20% return and stay for the community.

One downside however just like you suggested is we will lose out on a lot of upside in case Hive price skyrockets..

I would regret being greedy for 20% and in return losing out on doubling the amount in Hive lol because remember in HBD you only have a 20% potential but with HIVE you have the usual 8% curation + 2.83% Vesting increase AND a possible capital growth with technically no limit..

I believe most Hive users will do some of both, and won't do only one exclusively. New users may be attracted to just the 20% APR.

That's true. Just like I said the goal is that they come for 20% HBD but stay for Hive lol

What is a super majority for this to get implemented, and will is just happen when this majority is reached?

Thanks in advance

Needs 11 of the top 20 witnesses.

This is going to make HBD better than UST yields on Anchor since they fluctuate between 18-20. Also, you put your crypto into a contract that is prone to hacking. With HBD savings, your keys, your crypto.

No brainer!

What can we do to make other top 20 witnesses signal the same 20%?

Posted Using LeoFinance Beta

I highly suggest a cold wallet, which is perfect for this.

I'm pretty sure you will start seeing more signalling, this isn't my idea and I am not the first. I just wanted to put out a post to raise some awareness.

Posted Using LeoFinance Beta

How does cold wallet solve this problem? Once we deposit our crypto into a DeFi pool, it moves from our cold wallet to that particular contract. I feel dumb now, maybe I am missing something. 😢

Yes, I can see others signaling the same percentage. 20% should be the norm ;) HBD savings is going to be my top favorite savings account now.

Posted Using LeoFinance Beta

You can continously deposit into a cold wallet without ever logging into it.

Posted Using LeoFinance Beta

You can't make anybody vote how you want. But you can express your view to try to convince and also change your witness votes.

Where is this money (20%) coming from?

Inflation

I'm assuming inflation of Hive? Inflating a stablecoin doesn't make sense, the money has to come from somewhere or it's no longer stable?

Posted via D.Buzz

I think at 20% and the safety of owning your keys so far less risk than any defi.

Plus there is absolutely no third party risk.

The "counterparty" is the code on the blockchain. There is no application involved.

Plus the payout is in more HBD, not another token which brings another layer of risk.

20% with very low risk is what is being proposed.

Posted Using LeoFinance Beta

You are the first witness I see to vote for 20% interest. I saw a few people voting for 15%. Hopefully it will be increased from the current 12%. 20% would certainly make Hive Dollars (HBD) one of the most attractive options in the crypto space.

Not the first to think about it though. I believe @smooth signaled 20% before I did, he was the one who brought it up as a good time to switch.

Posted Using LeoFinance Beta

20 is really huge !

Really interesting things are going, that plus the Ads revenue from Leofinance !

That's the moment to bring investors and users ! !PIZZA

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

(1/5)

curation-cartel tipped themarkymark (x1)

vikbuddy tipped themarkymark (x1)

ykretz.leo tipped themarkymark (x1) @elyelma tipped @themarkymark (x1)

Please vote for pizza.witness!

That's a great news. I have already been keeping my HBD in savings.

20% is gonna be a changemaker for HIVE☺️

!PIZZA

Yeahp, cool. @taskmaster4450 & @taskmaster4450le seem guilty to me, very guilty.

I am guilty of a lot of things so there is a good chance you are right. Without the particulars, hard to either confirm or deny.

Posted Using LeoFinance Beta

Conspiracy to increase wealth of HIVERs by printing debt (HBD) on the HIVE Blockchain.

Guilty of what? Wearing white after labor day?

Posted Using LeoFinance Beta

what is wrong with that. Blends in nicely with the snow.

Posted Using LeoFinance Beta

No clue, I heard it from Dukes of Hazzard movie.

Posted Using LeoFinance Beta

Pearls of wisdom there. Hard to deny the lessons from the Dukes.

Posted Using LeoFinance Beta

To encourage the Power Up, and decrease the Power Down, I would also suggest an annual increase in the interest rate on HP by for example 1% (from 2.8% to 3.8%, 4.8% etc.). The bonus percentage will reset in the event of a Power Down.

This would counter the fact the inflation rate is dropping yearly.

Posted Using LeoFinance Beta

The inflation rate of HIVE is secondary as set by the blockchain. That said one reason not to change it is credibility. A chain that keeps monkeying with its rate of distribution is not going to be credible.

With the conversion, the inflation of HIVE will be altered as people convert. Over the past year, according to @dalz, we actually saw a decrease in the amount of HIVE outstanding.

You bring up a good point which is worthy of exploring: providing further incentive to power up. But that has to be done in other ways in my opinion.

For example:

instead of burning HIVE on account creation, put that towards those powering up.

charge a small fee on conversion that go to the stake holders

If this is something that is serious, we can explore it. I am sure the community can come up with a lot of good ideas.

Time to apply some business building techniques to Hive.

Posted Using LeoFinance Beta

Really a great thought here. In fact this post made me to notice that HBD savings at 12% was still giving a higher interest to Hive curation.

The balance is really crucial.

Posted Using LeoFinance Beta

Yes, your proposals are absolutely acceptable. many users earn HP for free from their posts, and then use it to sell it on exchanges, after doing Power Down.

It is something that should be discouraged. So rewarding stakeholders is an extra stimulus.

Posted Using LeoFinance Beta

I wish Splinterlands didn’t take most of my HBD away for needing things to buy hehe. I think 20% interest is pretty epic for us, let’s see if we can get the other witnesses on board!

The investors dilemma. Where to put your resources.

Hive is offering a lot of choices these days.

Posted Using LeoFinance Beta

Will it be too great of a dilemma? Is there such thing as too many choices? I support experimentation, sure. As long as we're quick to admit mistakes and correct them I have no problem with a little test. At the end of the day HIVE is diversified enough to afford some trial and error.

I think there's such thing as too many choices. You don't want to be spread too thin and miss opportunities with what you have because you are spread out too much to find out news that could be beneficial.

Dilemma indeed! I've been slacking on some of the other opportunities but hoping that I can make up for that with decent Splinterlands investments lol time will tell though!

Posted Using LeoFinance Beta

One of the best.

Posted Using LeoFinance Beta

It’s the right decision, the only thing is missing is adding more visibility to what we are doing here

This was specifically talked about and would be the one-two punch for this change.

Posted Using LeoFinance Beta

B20. This is the carrot that can become bait for donkeys that are not yet looking towards the Hive).

Posted Using LeoFinance Beta

So are you saying we are all asses?

Posted Using LeoFinance Beta

Lol, you turned my phrase hard, although, probably, when you don’t see the interlocutor’s face, this phrase may look like this. I was talking about those who believe that the hive is a soap bubble and turn their heads away from it)

I don’t divide into those who invest in the Hive, or in LEO, or another coin of the bottom of the blockchain, these are people who meaningfully bet on something, but, one way or another, they are already in the Hive. It was about potential, new users, sometimes very stubborn in their fears.

Yes, I must take into account that in English there is no diminutive, affectionate mood for the word donkey, as it is in Russian. on which I think)

That is okay. Most of us are asses. We accept it and move on.

In spite of that, we are building something pretty special so it is just a matter of time before the rest of the donkeys get on board.

Posted Using LeoFinance Beta

Before coming to the Hive, I did not notice such stubbornness in myself, yes, there is something in this and it’s not very bad to be a donkey)

This is great News. I will definitely switch over to HBD for the 20% APR.

20% starts to make me interested now. With 12% I felt no attractive sense to building HBD funds for passive income as I could most likely make more either through defi or simply through curation, and the interest on the hive. 20% starts to throw some of that out the window and starts making it an attractive option.

HBD savings eliminates any 3rd party risk that is associated with DeFi. Plus it basically negates any volatility issues that we see with other DeFi applications (i.e. token price crashing).

Posted Using LeoFinance Beta

20% is amazing, but 12% is pretty damn good and shields you from risk of Hive going down, but you lose the gains if it goes up.

Posted Using LeoFinance Beta

Great Post!

!1UP

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @bee-curator, @vyb-curator, @pob-curator, @pal-curatorAnd they will bring !PIZZA 🍕 The following @oneup-cartel family members will soon upvote your post:

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Interesting - I'm currently keeping almost nothing in HBD because 12% isn't attractive enough (compared with powered up hive, 2nd later tokens and other crypto stuff) - 20% would definitely get my interest though.

I believe it's important, considering that many financial sectors are already playing around with well above 15% on savings, to remain relevant and attractive would mean that it has to cross that mark.

20% is a good signal, any chances hive Is getting an higher incentive for staking?

~~~ embed:1512921263186104323 twitter metadata:S2VubnlDcmFuZXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9LZW5ueUNyYW5lL3N0YXR1cy8xNTEyOTIxMjYzMTg2MTA0MzIzfA== ~~~

~~~ embed:1513463735691718656 twitter metadata:aXRzanVzdG1hcmt5fHxodHRwczovL3R3aXR0ZXIuY29tL2l0c2p1c3RtYXJreS9zdGF0dXMvMTUxMzQ2MzczNTY5MTcxODY1Nnw= ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I agree, considering HBD is similar to UST, it should have a comparable APY.

Do u have any thoughts on putting a proposal out to use 1M usd of the dhf to buy btc and then put it into a multi sig account that guarantees a 1:1 conversion to HBD on hive internal market thus partial backing HBD with btc? Bitcoiners would likely start to see hive as a btc side chain at that point. Especially if we had a way to tip content on hive with lightening (which is basically already ready with BoL’s V4V system)

I'd support this with a lower exchange rate, essentially a backup, maybe 0.98 or so. This would also have the advantage of avoiding depleting the BTC backstop quickly. Right at 1:1, a lot of BTC might get redeemed. At 0.98 , it won't unless there is real stress on HIVE/HBD.

In the event that the BTC does get redeemed, this accrues a small profit to DHF, which always values and can exchange between HIVE/HBD at 1.00

Yes. Nice!! Also, assuming that the hive holders already have the btc they want, anyone else looking to empty such a btc pool would likely have already have had to buy hive off the open market to convert to HBD, likely pushing the market cap of hive up already.

The exchange rate should be set low enough to discourage someone using that peg for large orders and draining the pool, when they can get a slightly better usd btc rate somewhere else

Great idea, I would definitely support it.

Someone mentioned the APY on UST is going down. Not sure if that is true but it makes sense considering the number of tokens out there and how they structured things.

Posted Using LeoFinance Beta

Would love to see or learn more about these discussions! Is there a link or are these private chats?

If there was a link, wouldnt they be public chats then. 😁

Posted Using LeoFinance Beta

Right! Which is why I asked if there was one.

20% sounds great. I already put all HBD I earn from blogging into savings for 12% .. fatten it up and I might consider selling some of my other assets to deposit

Interesting thoughts.

@geekgirl already mentioned this change you decided to call on.

Also, there is a lot more awareness in Anchor Protocol and Terra than I suspected. Very nice.

!PIZZA

- EVm

I think it's a good idea.

This approach assumes that people speculating on HBD or profiting on the new APR would contribute to anything long term. Quick liquidity? Sure. Volatility? Maybe. Quite a few new signups? For sure! But will they ever become active users and if they do...will they share anything to HIVE other than speculation on their investments?

I think the money will come with the active userbase. A website where people mostly talk about crypto, lots of text, that's not attractive to the larger crowds these days. Let's make an interface for reels on a loop too...

Instead of raising the APR for HBD, if more active "regular" users is the goal, let's assign 1% of the pool to external marketing or create a proposal for funding. Let's buy a few endorsements from Cameo, get a few celebrities saying they signed up. Get people in here to actually use the network and its many tools, then the money will come, then speculators will come. Offer something exclusively to speculators and that's what you will get, they will bail the minute someone else offers 21%.

I hope I'm wrong.

I disagree, this makes Hive competitive to the biggest projects in the Defi space. Granted we need to work on our onboarding, but this gives us something to talk about.

We already have funds for marketing (DHF), we just have to use them on good ideas.

Posted Using LeoFinance Beta

I was not aware DHF could be used for marketing, thanks.

Part of me just feels like HIVE is too good already, at this point, with everything we have...I mean we have the holy grail of crypto, we have recurring payments!! You're making money with basically everything here, you're getting paid to give money away... there are tokens, it's open-source, seems like there's even NFTs, and this thing has been running for 5+ years so it has been tested. So many lives have been changed by HIVE, what is going on? I don't think the offer is the problem, no one else offers that much, no one can get a non-crypto user onboarded as smoothly, it's hard to even get a transaction confirmed as quickly as it happens on HIVE. Crypto-wise it's simply a masterpiece.

If anyone reads this and wants to help with a marketing proposal for Cameo, please, help me bring this idea forward to get funding for it, help me negotiate with the celebrities, the tools to connect with and hire those influencers already exist. Most people aren't like you!! Most people don't take risks with things they are unfamiliar with, most people just follow...

This has nothing to do with speculators. This is actually the opposite. It is part of fixed income market. It caters to a completely set of investors, or at least investment dollars.

Thus, risk/reward has to be taken into account. Will some jump a the chance for another percent? Sure. But at what risk?

HBD is one of the lowest risk opportunities out there.

It is:

If people are willing to increase their risk, then they can hunt for greater yield.

Plus, another thing to keep in mind is this is moving in the direction of collateralization. When it comes to that area, the risk factors I mentioned are vital.

This is helping to open up an entirely new opportunity for Hive. Accessing these two markets, fixed income and collateralization, could move things in ways few on here can even comprehend. We are talking in trillions when referring to those markets, not millions or even billions.

Posted Using LeoFinance Beta

20% Interest on HBD with 3 day locking is too good and it will make HBD the best stable coin among others...but will it be a problem in terms of inflation

How is that?

Posted Using LeoFinance Beta

When we have more HBD getting paid as on interest, there will be pressure on Hive as more and more Hive will be sold for HBD and will there be a problem on inflation when there is more conversion from Hive to HBD

Yes and that Hive being sold will reduce the amount out there, actually making HIVE deflationary.

Plus, we need more HBD if we are going to be a stablecoin. Do you think 9 million HBD is enough to engage in commercial activities?

We already have no liquidity in it.

Posted Using LeoFinance Beta

I would expect the 20% to be tapered back eventually. High interest like that should be available to long term stakers. I hope u continue to advocate for that task. But for now, temporarily we propose 20% for three day lock in, based on us actually building out the staking system. 20% Apr should be for 6 months stake locked in. Not three days. Hope u continue to push for that task.

Now we just gotta get a proposal out to get hbd backed by 1mil worth of btc and make sure that there is a guaranteed hbd btc conversion from a btc multi sig. that plus tipping hive content with lightening (which BoL has essentially completed ability to integrate into other front ends by API) puts hive at the front.

Our witness @threespeak will move to 20% Apr temporarily on the basis that we build longer term lock ins and btc backing

Certainly I will keep pushing for time locked levels within the Hive savings program. However, I disagree that 20% is high interest considering we need so much of it to be created. This is something that can easily be offset by growth within the platform. Just think of how much HBD is going to be required to conduct $50 million in commerce.

As for the backing of HBD by BTC, why do that? Why try to use collateral for HBD when that should be the collateral? There is no reason to hand that role over to Bitcoin. It makes no sense to me.

Posted Using LeoFinance Beta

IMO 20% too high for a three day lock. Happy to advocate for it temporarily to give hive best chance to meet its potential. But the sound thing to do is advocate 20% for a 6 month lock in. 3 day lock in at say 10% is better. (Obvs tech is not yet built for that).

Partial btc backing (say 1 mil worth of btc, 5-15% market cap) imo is great thing and will help bitcoiners view hive as more of a side chain than it already is. It’s essentially a hbd / btc liquidity pool that the hive chain printed up the liquidity for. I think it shows hive is very capable chain. Not many other chains could make that type of a power move

Yes I don't think anyone would suggest it be "permanent"

It is very important to make clear at all times that witness-set APR is variable and can change at any time. When the cost of interest exceeds the value of promoting the chain (either because the former is too high or the latter too low or seen as diminishing returns) I would expect it to be reduced.

If or when longer term bonding / locking system is built, one of its great features will be a guaranteed APR, rather than an APR that can vary based on witness signalling. If that can be built before the APR on the 3 day lock in gets reduced (for whatever reason) it will be quite a classy move. Will certainly put us ahead of other chains in this feild who have ultimately had to reduce their APR eventually. I think with the low market cap of hive and incredibly low market cap of hbd or usdh or whatever we end up calling it, the potential for this to outperform where others have failed is tremendous.

I think the jump in interest rate is too high a jump up, I think it should be increased to 15 % that way people like @taskmaster4450le and others within his calibre to analyse the performance of HBD after it is increased to the 15% rate.

I never said 15% is where the rate should be. When I put that out there, it is what I thought the Witnesses would raise it to after the hard fork.

The jump to 20% is perfectly acceptable. In fact, we could go much higher as we need a lot more HBD. For example, how are we going to get 10 million HBD in a liquidity pool? The answer is from conversion. There is no other way.

Once we have decent liquidity, people can start to develop use cases. HBD should be the de facto payment token that every application on Hive uses.

Posted Using LeoFinance Beta

Great idea here setting up HBD for 20% savings. WE know this will build more trust for HBD and we'll have more new investors especially as unlocking time for HBD is just 3 days.

With the point you've raise here, what measures do you think will help maintain a healthy Hive? There will certainly be a drift from Hive to HBD. I know that making 9% from Hive curation is rather not as selfish as making 20% from HBD saving.

My suggestions for Hive since its unlocking session is longer - 13 weeks:

Just my unprofessional thoughts though.

Posted Using LeoFinance Beta

The new account creation fee certainly should be directed at HP instead of burned. No reason to burn money.

Are you talking about the inflation rate staying the same and the distribution is adjusted based upon staking time?

My idea is to charge a minimal fee on the conversion (a half a percent might do it) both ways. This money would them be directed to the HP to help increase the return. If people use conversion like an exchange, then it could add a couple percent to the entire return.

Posted Using LeoFinance Beta

Locking up HBD for 20% interest could be a great move over holding Hive for a relatively stable $1. It can also be a very bad move if Hive goes to $2 or even $3 again. If Hive goes to $0.50, it turns out to be a brilliant move.

Posted Using LeoFinance Beta

fully agree with this! HBD only grows and stabilizes with more circulation and 20% should do just that!