Update

after writing the below article: Kraken replied and said :

“I apologize, but there isn't anything we can do for you here, unfortunately. Let us know if you have any other questions.”

The full reply is in the comments below.

end of update

Below is the original post I made on 6th November

Today I placed two small deferred "sell", "limited", orders on Kraken. Something went terribly wrong. Both trades had terrible executions. One was traded at around $90 below the market and the second order, 2 hours later, at about $125 below the market.

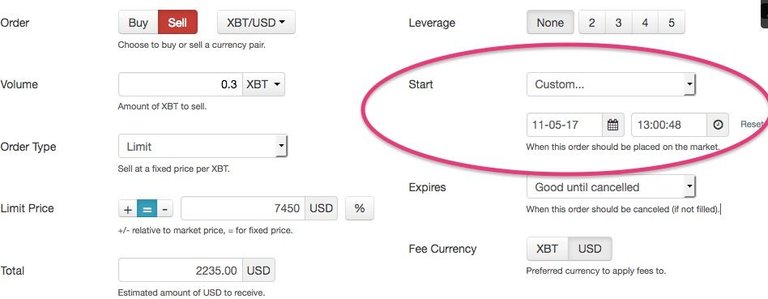

The instructions were identical, except for the time they were to be placed on the market (the "start" time). Both instructions were to sell 0.3 bitcoin at $7'450 or better. ("Limit" orders").

The whole point of deferring an order like this is to spread a sale throughout the day, so you get an average of the day's prices, but no worse than your limit. You don't need to stay in front of your computer to place the orders. They will be dropped in the market at the times you specify.

I set the time for my two orders to 13:00 and 15:00 (both based on the Kraken time). Those are the times the orders are automatically placed on the market. They can't be placed before the start time.

I set the limit for each of the sales at $7'450 which was slightly higher than the market price at the time I was entering the order.

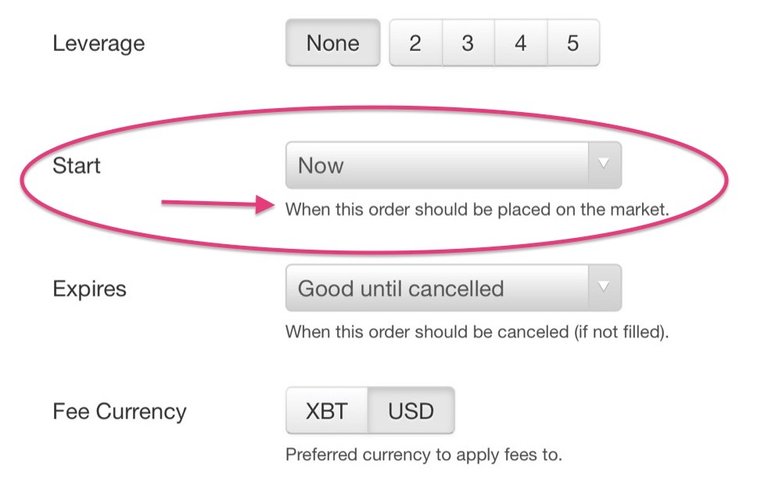

You can set the time when an order is placed on the market using the "Start function, as shown in the pictures below:

The whole point of a "limited" order is that if it is capable of being executed at the start time, you should get the BETTER of the "limit" price, or the "market" price. In both cases, I got the WORSE of the two. I am not talking about a few cents. I am talking about a difference of close to $100. This can't be accounted for by the spread between bid and ask. At the start time the bid-ask spread was minimal.

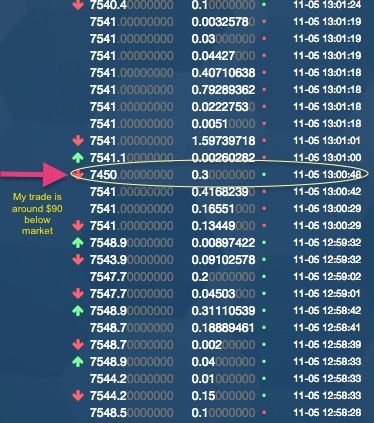

Below you can see the two price feeds of executed trades at the times of Execution. Here is the price feed of the first execution. The start time was set to 13:00, which corresponds to the trade time. You can see my trade highlighted. It was executed at my limit of $7'450 - which was $90 below the market:

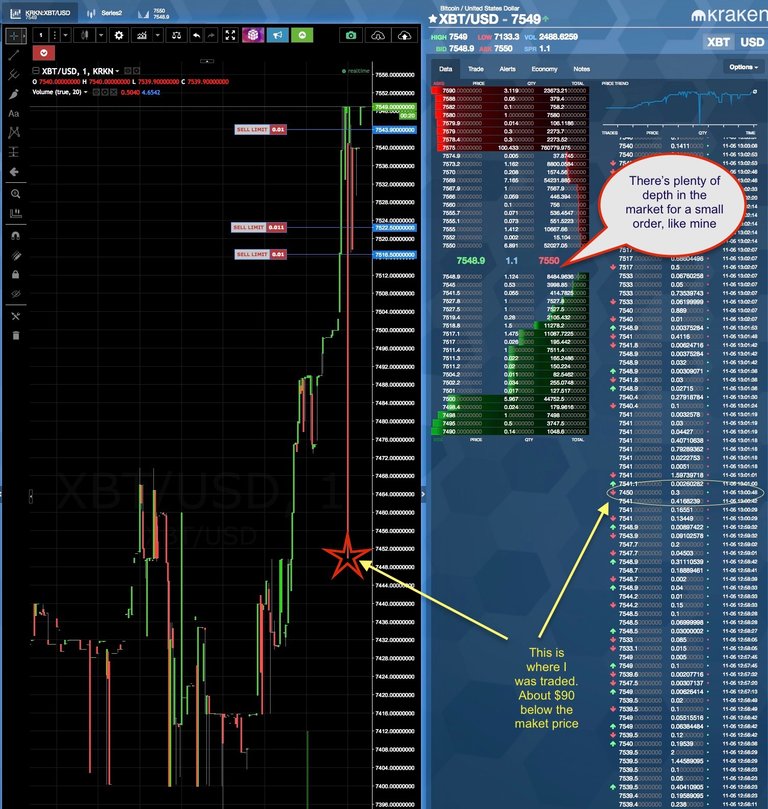

Here is the second trade that I set to be placed on the market at 3pm. This time it was also executed at my limit price of $7450, instead of the market price. The execution price was around $125 below the quoted bid-ask at the time.

Below you see all the trades and times. The red arrows are "sell" orders at the "bid" price and the green arrows are "buys" at the ask price. As you can see my trade was a "sale", except it was executed nearly $125 BELOW the bid price.

Here are some screenshots of the bar chart I took immediately after the first bad execution.

I don't know why my sale price, (twice in a row), was at the "limit" price, instead of the much higher "bid" market price.

I would speculate that it is most likely a software bug.

I put in a support ticket to Kraken to see what they will say. I will you know.

I received an automated email response as follows:

"Thanks for contacting Kraken Support. Your request has been received. We'll reply to your ticket as soon as possible, but in some cases it can take several days if we experience a heavy volume of requests. We have site content that answers many of the most common support questions. Please take a moment to visit the pages below and see if your question is answered there."

If you use Kraken, I would avoid using the "Start time" feature until this problem is resolved.

I would like to ask Kraken: "Who took the other side of my trade?" "What would have happened if my limit had been 1 cent, or zero?"

Will you continue on with your strategy or sit on the sidelines for a little bit to confirm that this was a one-off issue? I suppose you can place a min order to test it yourself, but where there's a mouse, there's mice! I'd bet that you'd be eager to make that money back, but it may not be safe yet with that strategy.

Hi @steematt The error occurred on two trades. The start time of the two trades was two hours apart.

After it went wrong on the first trade, but before the second trade, I did a test. The test was with 0.001 bitcoin. About $7.50. I set a price limit at $3'300. Nothing went wrong it traded at the market price of around $7470.

As a result of the test, I was confident that the first rogue trade was a one-off. Therefore I decided to let the second trade go through.

The test was identical to the error trades except for two details;

In the test my limit was already well below market. For the two which went wrong, the limit was slightly higher than the market when I entered the order.

The second difference is that when I entered the original order the start time was several hours away. for the test the start time was only several minutes away.

The key point is that it should be impossible for a normal trade to be executed outside of the bid-ask spread. Parts of the trade should be executed at the first bid price, then the second bid price and so-on.

Well you're cool, calm, and systematic about it, which will keep any losses under control. If it was a bug, they should credit you back, although that might take a while. I'm sure their IT Helpdesk is drowning with requests, and may need to investigate the system first, but you did the right thing by contacting them immediately to get up higher on their queue. I wonder if there's an escalation email distribution you may be able to find on reddit or elsewhere that can get you faster responses. I've found that to be helpful with my mining services.

To tell the truth, having looked at what people on Redditt have to say, I am not terribly optimistic of a rapid reply.

It's disappointing to miss part of the profit, but more disappointing that I can't trust the software for a while. Kraken has been around quite a while and I would have expected things to be less buggy by now.

something would happen, it would be a mistake of the system, hopefully they can solve it, if I lose that for me it is a lot of money.

I've read half of your post and already I can absolutely say that for sure it was a bug. I am going to continue reading it

I just finished reading, and as a developer, I faced a lot of bugs, and this is definetly one! In cases like this, the platform is covered by Terms and Conditions which protects them for paying you anything in case something terribly go wrong. Imagine if somebody would have traded 10000 BTC with a limit price left to 0... this is a bad one, hope you get a lot of visibility so that a lot of people will be aware of the problem so I'll resteem. Let us know how this turned out!

@mejustandrew, you are right, not only are they not going to pay me anything, but more importantly, they won’t acknowledge that there is anything wrong. I have tried to tell them that if you place a limit order which is capable of being executed immediately, you should get the bid or ask price, not your limit price, which was, in my case $125 worse than the bid-ask.

Here is their badly written reply:

From Kraken ...

“

Jen

Jen (Kraken Support)

Nov 10, 10:46 PST

Hi,

Your limit price was met. Usually a limit price that's beneath the market price will sell at market. In this case, your trade set the market price. This can sometimes work out in your favor, if you happen to get a sell at the top of a candle wick, but in your case you happen to have set the bottom. Trades like this are what set the wicks of candles, and cause great frustration for everyone else, who wanted to buy the bottom of the wick and couldn't.

I apologize, but there isn't anything we can do for you here, unfortunately. Let us know if you have any other questions.

Thanks for using Kraken,

Jen

Your request (number ******) is currently marked as "Solved". This means we think your issue has been resolved. If your issue is not yet resolved, please let us know by replying to this e-mail.”

Ha! And they have marked as "Solved" your request... They don't maybe have a good pertinent support team (maybe some third world country guys way underpaied) and they don't recognise a bug to signal to their development team, or they simply don't want to recognise that there is a bug in order not to lose the customers trust (which is sometimes a good marketing approach that I simply hate). Well, I'm sure you knew from the beginning that they aren't going to give your money back, but at least some excuses were nice...

I think it must be an error on their side, otherwise it is not possible.

I have never used kraken before but the thing you pointed out should never happen.

Lets hope you get a positive response @swissclive

Oh no, that's awful! What's going on with Kraken?

My experience with Kraken is that the 'limit' price is the price it buys/sells for.

Once I type in/put in a sell order for $.018 instead of the current $.28 .(I was not happy I didn't notice my error...:( )

It sold for $.18 because that's what I put the limit order in for. I've never had a 'limit price or better' experience on Kraken.

If the market price is better than your limit, then that is what you are ENTITLED to get, i.e. the market price. It's the same on every traded market on the planet and always has been.

If the market price is worse than you limit, then you have to wait for the market to be the same as your limit before you trade.

Kraken should be no different, otherwise it's a complete nonsense.

shrug Dunno. That's always been my experience of it, and I've never looked into it to see how Kraken defines it

, not knowing any different.

Hope so, I'll write in and complain if such is the case that how you describe it is how it's supposed to be on Kraken.

good

No man, it was definetly not good...

lol, lee @thura debes leer. you should read.

That's what happens when they do not read the article, they only comment without knowing what it says. The friend @ swissclive must send the publication about the spam.

I guess she has other things on her mind right now, as the lost of ~200$ but I know rhat usually she in concerned about spam

Spam should be scared away, while my friend deals with the problem of losing his money.

@thura It's not nice what you just did.

Congratulations @swissclive! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPstopped the active trading.. first some alts need to recover again.. but that placing orders with times is a good thing I remember..

Will you continue on with your strategy or sit on the sidelines for a little bit to confirm that this was a one-off issue? I suppose you can place a min order to test it yourself, but where there's a mouse, there's mice! I'd bet that you'd be eager to make that money back, but it may not be safe yet with that strategy.

Kraken is broken right now. Any time price surges you can'trade. The strategy is good, but thwarted by their technology. I will return to Kraken when I believe it is working again.

Wow shoudve included this in my post as well

You can edit your post to add a link if you like. To add a link - your text goes here, just do it like this:

[link - your text goes here](https://steemit.com/kraken/@swissclive/bad-trades-on-kraken)

I added a link to your post. You can check it out here : Kraken Problems

No intentions to spam, People should be made more aware of such things.

Use Robinhood. No commissions: https://share.robinhood.com/tunaida