16.68 is the decision zone. I expect a pullback based on symmetry from 2 prior swings. If it pushes past 16.68 the next target is 17.07 but we are definitely at a major crossroads as the inertial line is at 16.60 (aka pivot point) so we can expect an impulse move (up or down) will occur soon. So the price to watch is 16.68 as it is acting as current resistance, touched it once this morning

come to think of it, if I used XAG as the base chart and overlaid SLV then it might be easier for people to understand, but then again maybe it would be too complex

I chart it several different ways, the more important thing is for us to see an 'impulse move' to the upside this week. If it chops around this price for too long it will likely push down. Price + Time is the key, not just price alone

My TA is on SLV which is the trust managed by JPM so the price is lower than the XAG COMEX price. I track SLV because i can create option arrays overlaid on my long position

16.68 is the decision zone. I expect a pullback based on symmetry from 2 prior swings. If it pushes past 16.68 the next target is 17.07 but we are definitely at a major crossroads as the inertial line is at 16.60 (aka pivot point) so we can expect an impulse move (up or down) will occur soon. So the price to watch is 16.68 as it is acting as current resistance, touched it once this morning

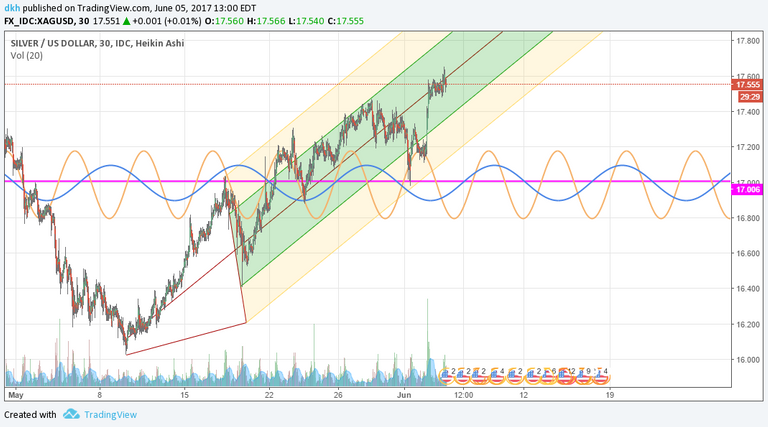

The price is sitting at 17.56 US now. Cheers

come to think of it, if I used XAG as the base chart and overlaid SLV then it might be easier for people to understand, but then again maybe it would be too complex

To complex for me I'm afraid! Cheers

Just for you. I made a chart of XAG. The chart reads "bullish" but is is definitely sitting at a decision point

It looks like it's starting to build a nice uptrend.

I chart it several different ways, the more important thing is for us to see an 'impulse move' to the upside this week. If it chops around this price for too long it will likely push down. Price + Time is the key, not just price alone

My TA is on SLV which is the trust managed by JPM so the price is lower than the XAG COMEX price. I track SLV because i can create option arrays overlaid on my long position