With people talking about stacking Silver and Gold, I started to think about how many precious metal investors have an exit strategy once the metals skyrocket. After watching the latest surge in Bitcoin and the subsequent pullback, I began to think how many Bitcoin investers actually sold some of their coins, Taking some of their profits off the table after such a huge rally in a relatively short time frame. Or did most investors just sit back; watch it rise feeling the rush of a quick profit, only to see it evaporate before their eyes, just before they decided to sell.

I would like to know what exit strategy the Steemit silver & gold investors have in place. What price are you willing to cash in, all or a portion of your stack? Or are you planning to roll over some profits into another asset class? I would love to hear what your thoughts and strategy are and what your sell signal will be.

Thanks for reading my blog, follow me and I'll follow you. Cheers

Warning! This is a trick question. At what point during drastic hyperinflation are you going to sell your good money, that has endured through all human history, to purchase worthless royal toilet paper?

We have all been subjected to "dog training" (especially over the last 5 years) where every slight rally in our chosen money is followed by a punishing loss of purchasing power. Unmask the wizard! The brutal royal fraud is at his end of days.

But of course you already know this, you just want to elicit the response. And of course all of those/us saddled by debt and living in fear would like to balance the books by settling debts. Reset.

Your right, but you will have to sell some eventually, we all have wants and needs. So you are going to have to let go of some eventually, into whatever the majority of people choose as money. Either that or you take it into the afterlife. I will be using some to move into other forms of hard assets like property, and maybe some ETF's when the prices return to reality.Cheers

Ah, well then what would I spend it on, that's different. I tend to take the long view on these things and not even consider that we will have to "exit" back into something when we have already found God's own money to use. (Our Father who art in Nature)

And you are pointing to another thing: that SAVINGS is a kind of sacrifice. It is a choice, a restraint, self-denial, a predilection not to over-consume. Sound economics is built on savings, investment and production, that's how wealth is created. Keynesian economics is a form of feudal slavery that favors the destruction of wealth for the masses of humanity.

From my experience in Asia during financial crisis in 1998: gold price tripled within a year and real estate value crashed about 40% in hyperinflationary situation (interest loan was about 35%). My PMs position now is 20% silver and 80% gold; my exit strategy will be wait for the hyperinflation, sell half silver and some gold and purchase a property for my daughter, and retire (I'm currently 53).

Thanks for the info, I bet you wish you had a lot of gold back in 1998. You would be worth a fortune today, but only if you sold your gold and rolled it into those cheap properties. I don't think you will have to much longer to wait to get your plan into action. Cheers

Keep on buying the metals, the financial situation today is much worse than 1998. PATIENCE is key here.

Very wise words indeed. And as the great Jesse Livermore said. "Be right and sit tight". Cheers

First let me state that silver's fair market value will probably never be in place. It may slip out of the manipulaters hands a little but never fully. The big banks own to much of it, you would have to see the dollar crash before controll is lost.. I have an exit plan and i also have a price that i will sale at. This could easly change depending on how fast

the upmovement went. I like your thought process, I have talked about an exit plan in several of my blogs. There are 2 very important things when it comes to silver. 1.owning the physical and 2. How will you sell it. Great post my friend.

Your dead right, Buying precious metals and sitting on them is the easy part, the hardest thing about investing in anything is knowing when to sell. Just ask yourself how many Bitcoin owners wish they sold at the top before it dropped nearly a $1000. Cheers

Yes ,but many say this is a market You do not want to sell !!! The world has never seen what we are going into!!! The whole worlds financial situation is in a bubble!! Thats why the Cryptos are going up so much ( there Not managed like Gold and Silver are and have been for Years.) .... Cryptos are acting as Gold and Silver should be acting!!!! If they were in a free market!!!!

Yes , your right I bought Bitcoin at 600 watched it go to 2800 then down to 1900,,but now its back up to 2515...

Whats going to happen when the Bond,Stock , Housing and Derivatives Markets blow up????

Where all all those 100s of Trillions of dollars going to flow into ???

My guess would be Gold ,Silver and the Cryptos....

So we are in for a ride in Gold and Silver as they loose control of these markets!!!!

I believe Gold and Silver will be to precious to ever sell!!!! I will trade my Cryptos for the things I want!!!

Just what I am going to do!!

Would you sell your precious metal for any paper currency not backed by anything , but the good faith of your government???

Gotta love @glitterfart. They have hit a few of my post before. Very cool.

Yes it was a nice little surprise. Is that a picture of your dog?

It sure is.

Is he a British Bulldog?

He is.

A really interesting question you've posed here. While if you sell at the right time and invest into another asset class there could be enormous opportunities to be had, my guess is that most gold bugs would never sell unless they really had to.

Thanks for your comment. I think I'm just trying to encourage people to ponder, the sell side of the trade. Cheers

@silverbug

I am not selling any Steem for the coming few years. I have held all my btc, gold and silver. I am a buy and hold type of man, and that also refers to other things. Unfortunately I screwed myself with Seadrill and Transocean, I have held them through the oil crash and lost 90% of my money. Don't care - that's my way. You do it your way.

You will have to sell something eventually, unless you plan on working for ever. Thanks for your input. Cheers

@silverbug

I dont bind the selling point to a fiat currency price at all. As it was said here, inflation can make the real value of a currency very relative. Whats the use of selling a ounce for 600$, if a burger costs 500?

I only sell, if the purchasing power of whatever I'm getting makes it worth selling. And sure I wont sell all of it at once.

What if you need to eat that $500 burger or go hungry like everyone else? and the vendor of the burger only take fiat as a medium of exchange, do you not need to convert some silver?

What if... I dont know, I'll cross that bridge when I come to it. If I have to sell some, I sell some. And if the vendor insists on getting hyperinflating fiat money, he's a idiot.

For me personally, I will make sure that I can avoid having to buy his $5oo burger. By making my own burger until the idiot comes begging for my silver, and then I will tell him how much silver he gets for his burger. Thanks for the comments. Cheers

Awesome post my friend. It would be hard to sell my Stack for paper money but I guess if I had to I would. But things will have to get bad. I have some pretty good stores of goods to last me along time so I hope to get through the worst of the coming storm. DR

That's the key I think, you hit the nail on the head, preparation is not just buying silver and hoping, It's about not having to converting your silver into fiat just to buy a burger for $500. Awesome comment as always. Cheers

Thank you. Yes I am not looking forward to the day when it all falls apart I can tell you that much.

I cant foresee getting out of real silver or gold...ever. Fiat currencies come and go. When they do, people go back to real money which is silver and gold.

I guess it depends on what the majority of people are excepting at the time you need, or want to buy. Cheers

For me personally I couldn't say at the moment I think you'll know when the time is right or at least I hope so mike

It's always harder to know when to sell, buying is the easy bit. Cheers

@silverbug

That's a question I will have to answer when the time comes. Since we are awake enough to be stacking now, I'm sure we'll know when the time comes. Make no mistake, there could be a silver/gold bubble. When silver/gold have their epic historic run, do you really think the sheeple will stop buy it when it is grossly overvalued? If there are no fiat currencies, you can still take advantage by buying commodities, like oil or land, that may be undervalued in silver terms. If someone has a Pilatus PC-12, and they need 20oz of silver for brain surgery, you get the plane.

I couldn't agree with you more, I think a lot of stacker don't even think about the sell side of the trade. So that was the main point of my post. But unless you are leaving it for the kids, or taking it to the afterlife, you will have to sell some eventually. Thanks for the comment. Cheers

I would never be without at least SOME metal exposure in todays world. I think silver and gold may be ready to start moving up again. Here is an article I wrote breaking down some mining companies, the better of which should outperform the metals themselves by a wide margin. https://steemit.com/money/@motowngold/i-think-gold-and-silver-are-staging-for-a-run-here-are-some-mining-stock-ideas

Thanks for the comments, you are 100% correct on the mining shares, shares are always a leverage play to the commodities they are mining. Cheers

I hope us silver and gold bugs have a profitable next couple of years, that is what I am expecting truly. Good fortunes!

The charts are starting to look promising, the down trend we have been in since 2011 seems to be indicating a reversal. We will just have to wait and see, but I think your right about the next few years. Cheers

I would consider progressively selling a percentage at ten dollar increments, starting at $30. But with that being said, I don't think I'd sell more than half, even above $50. At that point, such a high price would probably indicate major turmoil, inflation, or both. Ideally, I'd like to hang on to most of my silver until fiat currencies begin to fade out in a major way.

I should add, that I'd only sell to buy something else. Maybe an investment, maybe a car, maybe a house. But not to put into the bank or to hold in cash.

That's the way I'm thinking, but in my opinion $30 dollars in today's money is not even close enough to pry metal out of my hands. Great comment. Cheers

@silverbug

I'm selling my silver when 500 oz of silver can buy me a house hhaaaaaa

Yes, interesting thing is that you can buy a $150,000 house with only 60 bitcoin. Which was around $.60 cents 7 years ago. $300 oz for silver should be realistic. It should really be $15,000 oz and it could be.

Absolutely, but my crystal ball wasn't working to good 7 years ago with Bitcoin, and I missed that rocket ship. LOL

But I'm patient and I will wait for the silver rocket ship to launch. Thanks for the comment. Cheers

@silverbug

$500 sounds like a great number to me. To the moon. Cheers

That's a tough question. I suppose that if the price of silver were to skyrocket it would almost certainly mean the purchasing power of the dollar has crashed further than it already is.

At that point you'd almost have to sell a little bit of silver because your fiat dollars would buy less and less of your everyday necessities.

I believe that if silver hits $30+ I'd probably begin selling a little here and there and buy hard assets with it like land. But I'd never sell it all unless I had no other choice. I love my shiny.

dc8russell 38 · 2 hours ago

Yes ,but many say this is a market You do not want to sell !!! The world has never seen what we are going into!!! The whole worlds financial situation is in a bubble!! Thats why the Cryptos are going up so much ( there Not managed like Gold and Silver are and have been for Years.) .... Cryptos are acting as Gold and Silver should be acting!!!! If they were in a free market!!!!

Yes , your right I bought Bitcoin at 600 watched it go to 2800 then down to 1900,,but now its back up to 2515...

Whats going to happen when the Bond,Stock , Housing and Derivatives Markets blow up????

Where all all those 100s of Trillions of dollars going to flow into ???

My guess would be Gold ,Silver and the Cryptos....

So we are in for a ride in Gold and Silver as they loose control of these markets!!!!

I believe Gold and Silver will be to precious to ever sell!!!! I will trade my Cryptos for the things I want!!!

Just what I am going to do!!

Would you sell your precious metal for any paper currency not backed by anything , but the good faith of your government???

Clif High says 600 ....Then parity with gold at 4800 dollars an oz... Would you sell for 4800??

Why would you sell to get back into the same system your trying to escape from???

It's not that I am waiting to sell my silver for fiat, I cant stand fiat toilet paper. My point is at the moment fiat is the medium of exchange, not silver or crypto's, and if you want some other type of commodity or other forms of assets like land or equities, you will have to convert into what ever the medium of exchange is. So I was just asking what is your sell point to transfer the money out of silver into another asset classes. Cheers

I feel exactly the same way, but my sell price would be quite a bit above your $30. Me personally I wouldn't even start to think about it until we get close to $100 in today's dollars. Even better is to stock up on some everyday necessities, and they can keep their stinking fiat toilet paper. Cheers

@silverbug

clif high says $600 in a year -- that would be nice -- but what would our world look like>

Yes he says 600 ....Then parity with gold at 4800 dollars an oz... Would you sell for 4800???

thats a good question, I want to understand what is the new currency...what will replace the dollar and why...does that make sense?

I don't know, but it would be a lot better for a silver stacker, I think. Cheers

I think the rise will be based on many things -- a new product which may require silver and there is only so much or maybe a currency back mover -- or the silver rigging come out ..... a person can dream

I don't think it's a dream to have silver go to a fair market price, do you? Cheers

once the criminal element is removed -- who knows what is a fair market anymore -- we don't have them ?

But eventually we always return to something more realistic, and then you will have to sell some metal to rebuild the society. Cheers

the society may look very ugly at that point...this is a war for power

I would put most of your investments in cryptos and a smaller holding of gold and silver. It is a nice feeling to know you can hold and touch your metals though lol

No other money can match the feeling of a big silver or gold bar in your hand. Cheers

The answer depends on a lot of things, however it is unlikely to be a good idea to sell for fiat.

When I do sell for fiat it won't stay there for long it will go straight into some other hard asset that produces an income. Cheers

That's right. It is probably better to call it buying or investing rather than selling.

You have to sell into the medium of exchange to buy another asset class, don't you think? cheers

If silver is money, then no.

"Measure your silver in ounces, not dollars!"

I'll probably trade some for an engagement ring if I can ever find Woman that can tolerate me for more than a couple years. lol.

That's the only thing I've consciously thought about using it as money for, especially because a jeweler will obviously be willing to take it and know it's value.

In that situation I would be looking to trade silver for the ring without converting to any fiat currency in the middle.

LOL!! If you have enough silver, when you meet the ONE, preferably not a silver digger, you can buy the whole damn jewellery shop. Cheers

lol

Trade everything - ag commodities, stocks, bonds, precious metals, etc using AIM

What is AIM?

"AIM" (Automatic Investment Management) system of investing by Robert Lichello

http://cheapogroovo.typepad.com/blog/2016/11/automatic-investment-management-aim.html

Thank you very much for sharing this materialExcellent post dear friend @silverbug I congratulate you on your investment, there are three investments that always gave results, silver, gold, and property compar.

Thanks for your comments I appreciate that, your really cant beat tangible assets over worthless paper. At least it's something real and solid. Cheers

Come by here and say hello to have a beautiful day

When silver gets over $100 an ounce I might think about it, but I stack for the long term

That's a similar number to what I was thinking of, but I would have to consider what the inflation rate is at the time. I will be selling a little bit at a time as needed. Cheers

Sounds like a good plan!

USD 600,-- is my sales price per ounce on silver. The development in photovoltaics, electromobility, IOT, industry 4.0, flying cars (see the latest Airbus concept) - all impossible without huge quantities of silver. Since I am a mining engineer and run my own company in automation equipment I believe to have the right background to judge the situation how it is. Unfortunately Mr. Market is impossible to judge correctly, isn't he?

Im looking into getting into the PM so your information is very educational for me.

You will defiantly find everything you want to know in the steemit precious metal community. Cheers

@silverbug.

thanks

@silverbug This is a great post! Glad to know when we should sell :) If you get the chance, can you upvote my newest post where I teach you how to $20/Day on Steemit? :) Thanks! https://steemit.com/steemit/@parkermorris/how-to-make-usd20-day-on-steemit-with-no-money

Great, thanks for the comment. I will follow all of my followers, and I will have a look at your posts. Cheers

Selling may not be the term I would use... trading is more like it. What will I trade to an unfortunate individual (one that did not plan so well), is good money silver, gold, cryptos, for something tangible they have that I want.

I see this as a balancing act... someone that suffered the ridiculous "markets" while others spent foolishly, now is in a place to help that unfortunate soul get back on their feet and me as a punished saver now gaining more value.

Be it real estate, farmland... a lake maybe, or hell just a Porsche.

I agree with what your saying, But you will have to sell into whatever the medium of exchange is at that time. Then exchange that for what you want to buy, unless we go full Mad Max and all we have is barter. Cheers

Bitcoin IS GOLD. All of crypto is in a true bull market which only happens once or twice in a lifespan. The last time this happened was the internet boom in the 1990's. Crypto + IOT is the boom of the next 10 years , it is nowhere near being any kind of bubble it is just getting started. BTC could easily go to almost any price in 10 years. It is easily going to $3k this year and it could be $6k next year and so on.

Do you hold any bitcoin?

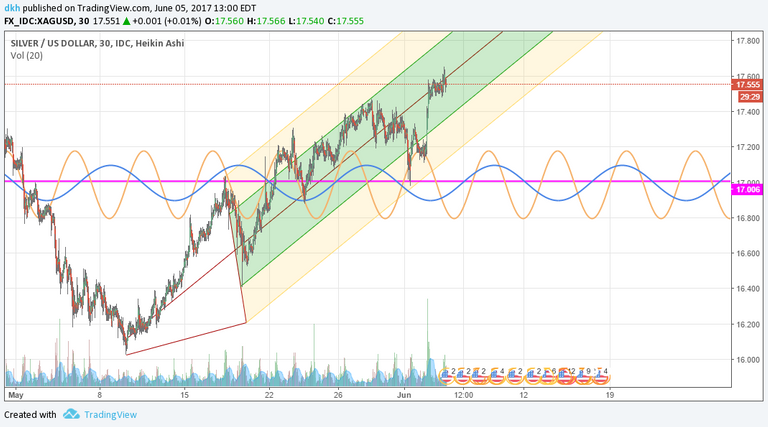

Short term buy or sell, here is my TA on Silver

So what is the chart telling you?

16.68 is the decision zone. I expect a pullback based on symmetry from 2 prior swings. If it pushes past 16.68 the next target is 17.07 but we are definitely at a major crossroads as the inertial line is at 16.60 (aka pivot point) so we can expect an impulse move (up or down) will occur soon. So the price to watch is 16.68 as it is acting as current resistance, touched it once this morning

The price is sitting at 17.56 US now. Cheers

come to think of it, if I used XAG as the base chart and overlaid SLV then it might be easier for people to understand, but then again maybe it would be too complex

To complex for me I'm afraid! Cheers

Just for you. I made a chart of XAG. The chart reads "bullish" but is is definitely sitting at a decision point

My TA is on SLV which is the trust managed by JPM so the price is lower than the XAG COMEX price. I track SLV because i can create option arrays overlaid on my long position

Hi @silverbug, great content! Upvoted! What is your opinion on the likely rise of gold in my article? Do you agree with it? Thank you! https://steemit.com/gold/@unknowncrypto/the-bulls-are-returning-to-the-gold-market

Thanks for the comment, and I will have a look. Cheers

New follower here. The thought of getting out never enters the minds of some. I feel it is all a matter of not getting out but moving things around. When food is not plentiful that is what will be valuable. It all depends on the big picture. Thank you and take care.

That was the idea of the article to ask people what they will buy once the metals skyrocket, not to just put it back into paper. But to buy something else you will first have to put it back into paper, which is the medium of exchange at the moment. Then go and buy your new asset, car, house what ever. Cheers