It's been a tough year, and people are looking for a much better 2021...I'm still focused on this year though...I have a budget to write after all.

I was looking at rental trends in the course of my job today and thought I'd share some.

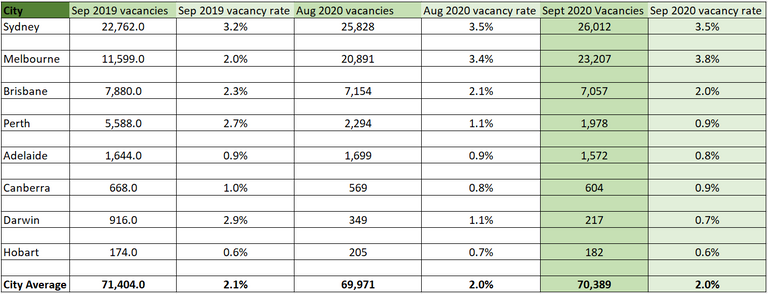

Vacancy rates and vacancies

I found it interesting that the national vacancy rate this year is is slightly lower than 12 months ago when, due to pandemic job losses I would have thought it would be a little higher. There was some fairly hefty stimulus money thrown around by the Australian Government which has probably held the vacancy rate down I guess though.

You'll note most capital cities have recorded a decline in vacancy rates in the September month although both Melbourne and Sydney have higher rates, Sydney marginally but Melbourne much higher, clearly due to the severe lockdown measures the Victorian Government imposed during their second wave of pandemic.

September 2019 to September 2020 is fairly stable though, which surprised me a little.

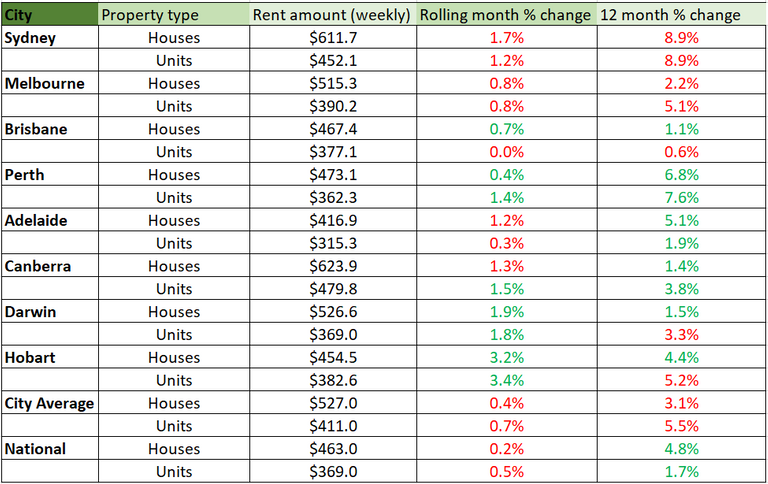

I find the next set of figures really interesting. It shows weekly rent amounts for houses and units across the capital cities and nationally.

Take the eight capital city weekly house rents for instance. You can see the two largest cities in Australia, Sydney and Melbourne, suffering huge huge dips in weekly rent over the last 12 months with the smaller cities like Adelaide, Perth, Canberra and Darwin recording strong growth in weekly rent. Brisbane, also a huge city, has very small growth only.

It's also interesting to note the sharp decline in Hobart for unit weekly rents; A direct correlation to the fact that much of the Hobart unit-market was taken up by short-term rental, AirB&B tenants, rather than long-term 12 month leases. Of course that segment dried right up in the pandemic...I bet you there are many unit owners in Hobart wondering how they will service their mortgages right now...Whilst sustaining empty properties.

Nationally though there is a trend upwards in weekly rents over the last 12 months in both the house and unit segments. This is good for investors of course, but not so good for renters...Wages are not keeping up with these increases in rent, or in sale prices for that matter; This is a massive issue.

I thought it might be interesting for you guys from other countries to take a look at these figures, gathered from SQM Research, in the course of my day today. It's part of my job to keep the team at work apprised of the trends, and it's essential for me to know what's up and down in the market place as I need to advise my clients effectively, and from a position of understanding.

This may seem like a simple set of figures, but its figures like these that huge decisions are made around and, I'll be honest, some of it was expected, and some was a little surprising to me...And to many investors; Some are happy and many are not so happy. This comes more into play when I look into the vacancy rate in specific areas around cities, which I will do for Adelaide, my home city at some stage.

So tell me, what's going on in your neck of the woods...Are rents up or down, vacancies up or down? How's your investment going and how do you interpret the fluctuations here?

Design and create your ideal life, don't live it by default - Tomorrow isn't promised.

Be well

Discord: galenkp#9209

Interesting to see the prices for rent going down, while in the larger cities in my country the Netherlands, rent prices went way up compared to last year, between 4 and 6 percent. Though in recent months (maybe last half a year), the rent prices came down, as they say due to: less AirBnB and less expats.

We are in our 2nd lockdown since a few weeks, which will continue at least till mid-December. Wondering what this does to rent prices and all. Restaurants, Bars, Museums, Concert halls, are all closed, so nothing to do for tourists. Though I love the renewed emptiness in Amsterdam :)

Guess 2021 can be a bummer as well when we continue lockdown after lockdown. I do hope our government listens to my suggestions I posted to one of the members of the governments advisory team... Not only listens, but also execute accordingly so we can pickup accepting tourists again, and let the expats return to the beautiful Venice of the North :)

Posted Using LeoFinance Beta

We're in a property price bubble here, drive by lack of supply and government stimulus and incentives. Here in South Australia, a new home buyer (never owned property before) can gain up to $40,000 from the government if they buy land and build. It's a lot of money considering the average house and land package is only around $400,000. (A basic house on only 300m2 of land.)

The bubble will burst though, eventually.

I was surprised to see rents going up in places, but that's an overall snapshot and when I drill down deeper the numbers are a little more alarming and certainly vastly different from city to city around the country, and within my own city, suburb to suburb. It's not a situation that one simple post could ever explain.

I hope you can see an end to the lockdowns soon and things can return to normal.

!ENGAGE 25

I suppose also in my country a bubble is created in house prices. Not by stimuli of the government, but by international investors (Russians and Chinese) buying with big money. Some say, because London and Paris become too expansive, they started buying in Amsterdam. By now these investors are looking at surrounding cities as well to buy due to exploded prices in our capital city. The low interest rates also doesnt help, and knowing these interest rates will not go up any time soon, it'll result in Dutchies with a relatively ok income to overpay for apartments and houses just to be able to move away from expensive rentals. Interesting times ahead of us, thats for sure :)

Hopefully indeed :)( But I expect more lockdowns to follow; Our government doesnt have a long(er) term plan, unfortunately. I guess in Aussieland no problems with COVID at the moment due to your Summertime?

We get a lot of. Honest buyers here too, disturbingly the commercial property buyers are communist party members mostly. They come here with big money and buy up and then don't do anything with the property, no businesses etc. It's a problem but our government allow it so I blame them. It happens to a degree with residential property too. It's alarming, but people just stick their head in the sand over it preferring to make a grab at short term money with no care for the long term problem it's going to create.

Melbourne was recently totally lo led down for almost 4 months due to a second wave of pandemic...Most other States were fine, mine included. It may happen again I guess.

Thats the problem of the last many decades I think, we become more and more short term focussed, while becoming more blind for the longer term effects.

Hopefully not :)

I guess all we can do is command our own actions and hope for the best. But in a society where money seems to do the talking, corruption is rife and governments are so short term...It doesn't bode well.

100% agree! :)

I should sell my apartment, monetise while the market is up and buy back in a dip...hmmmm camper van is the solution I suppose: living and travelling in one :)

ENGAGEtokens.Interesting stats, especially the yearly ones! I believe that with the second wave coming there are great investment possibilities coming (I've seen quite a few during and after the first one here) but only if you are able to sit out the pandemic and it's money that normally would sit somewhere anyway.. We have no clue how quick things change currently, so buying property for low prices as an investment for later when things are calming down, is a smart move if you ask me.

I wish I had that money laying around currently, but I don't. Thankfully, we managed to secure this rental apartment until next summer and with the changes coming up in our personal life, I suspect we may buy a property around that time instead of leaving the country. On top of that is this job opportunity that came on my boyfriend's path, too good to refuse for the desire to move to another country. This opens up many doors, so I guess in some months I will be exploring how this all works lol. But for us to live in :)

Posted Using LeoFinance Beta

If a person has the funds to purchase a property for investment purposes there could be some benefits, of course one needs to consider all of the factors that come into play, not least of which is overall return on investment in a very fluid market. Clearly the Australian market place is a little fickle right now, ups when I'd expect downs etcetera and it would be a brave investor to attempt to pick what may happen in the future.

We're in a property bubble here in Australia (generally) and bubbles burst...That's when people get burned.

I can only speak for the Australian market, and even then only really for the South Australian market which is where I have operated as in the property industry for twenty years...Even then the market has thrown up surprises, and will again.

I believe the pain of the pandemic situation has not yet hit, the financial pain, and I for one am not thinking flamboyantly from a financial perspective.

Thanks for responding and I hope you're able to fulfil your property plans.

!ENGAGE 25

Yeah I can see you have a lot more insight than I do, but I don't have to consider the Australian market thankfully, even looking at the rental prices scares me :) Our rent all in is about 1 weeks rent displayed in your post :) lol..

Real life is lately very simple actually, riding the waves how they come. Just like with crypto. Discuss our needs and desires, envision, plan.. but then when things change, try to be flexible and have plan b and even c.. Knowing that there will be calmer times and we just change the order of our plans according to what's happening currently. It's the easiest way to deal with it for me :)

Rents here can be quite high. I signed a new client today, for my team to lease their residential property at $1200/week (AUD). Pretty high really I guess.

I think it's smart to have some plans,and thoughts at the very least. It seems you're doing that, thinking things through, which is smart.

holy shit, 1200 a week. PFF they must earn a fortune lol ..

And yeah, thoughts and thinking it through defo. You know, before spring, our plan was solid and the best option. Then covid hit the fan and things changed.. not like we could have seen it coming I guess. It's fine as long as we are flexible, which we are, we'll manage :)

Have a nice day!

Yep, a lot of money...We manage some properties at over $1500/week too. Insane.

Anyway, thanks for your comments, much appreciated.

ENGAGEtokens.Right today rents are down some in Yuma County, AZ. The reason given is that the Canadian Border is closed and roughly 40% of our 'winter visitors' are Canadian.

Housing prices seem up a little, at least the asking prices. Don't ask me why. Spillover from Phoenix, I'd guess. A lot of what you call Hobart properties went on the market there a few months ago and it seems all of them sold. The housing market in Phoenix is just red hot right now.

It's frankly a bit upside down from what a normal market would expect. That's mostly due to the fact that our population triples every normal winter. The only thing that keeps Yuma from being an absolute real estate vortex is that there is roughly a 10% turnover every winter. 10% die or stay home because of health or just age and 10% newbies come in...

I agree with you in that things are a bit all over the place, it's the same here. The word normal isn't a very good one to describe things and I think, when all of this stuff is concerned, normal is something that will be quite elusive for a long time, maybe forever. It's not all covid related either...Australia's economy was headed down the drain well before Corona-chan came along.

You mention a few points in your post, the lack of tourists coming down...It's the same here to some degree, and a greater degree in the more tourist-oriented States. Job losses, wage reductions etc. That can't all happen so rapidly without repercussions and I feel whilst more people do a good job at sticking their heads in the sand, it can't be done forever. Reality will bite; Not for all, but for many.

Time will tell though and in the mean time I'm not thinking flamboyantly, in fact Faith and I are preparing for the worst. If it happens we may survive it, if it doesn't we'll be better off financially.

!ENGAGE 25

The piper is going to have to be paid. No question. I know several people that are semi-retired and work during the winter tourist season. They all say that casual winter jobs are just plain hard to come by right now.

The ripple is pretty big here. Food service and hotel workers, of course. The landscape crews are well under normal due to the Canadian contingent not coming yet. All the service industry will be affected.

Yeah, it's a cascade effect really, one thing leads to another. Same here. When they. It off the stimulus pa kahes in March 2021 things will get real.

We've had a bit of a gap in our packages. I actually expect a 'lame duck' bill (done by the out going legislature) that will pick up some, but that band will get paid too.

Eviction protection has expired in some places. I think there a bunch of them upcoming. That'll put the shakes on the whole market, a bunch of people are going to 'move down' one or more category. It'll get ugly in a hurry.

Yep, similar to here. Eviction protection is ended, stimulus ramping down, jobs still being lost, rents going up, credit debt on the rise...Pain on the way.

ENGAGEtokens.Molto interessante, complimenti

Grazie, apprezzo il tuo commento.

In my neck of the woods rent has gone up slightly for apartments. However, real estate sales for housing is through the roof. Construction of new housing uas slowed but people are purchasing full speed ahead. Commercial real estate has tanked though.

Yep, commercial property isn't the best to be in at the moment...We manage billions of dollars worth of it and we have a lot of very worried owners...Whose tenants can't pay...Not only mum and dad tenants either companies.

Housing construction here is strong though, a $40,000 grant for new builds is on offer from the government and there's many slabs going down. The problem is that many of those people have over-extended themselves from a lending perspective, mainly through the relaxation of lending criteria the government have allowed with the lenders; It had tightened right up after the banking Royal Commission but has been loosened since covid. This is a future problem for many, and will cause a glut of properties on the market forcing prices down and with few buyers to buy them...You know.

Sale prices are strong here, through lack of supply but again that will revert as more stressed properties come on the market. People keep thinking that it'll be great and they can pick up a bargain, but mostly it's not the little guy picking them up, it's people form overseas and those like one of my clients who owns a business that turned over $2.6bn in the June 2019-July 2020 FIN year. He already has a few hundred residential and hundreds of commercial sites with no sign of slowing down. So, once again, the little guy misses out while the Gina Rinehart's of the world earn more billions.

...Meanwhile wages don't keep up with inflation and those who can least afford it hold to their consumerist ways.

How useful is a year's worth of data in the property industry? Do you use 12 month trends or look longer term? Say 3 or 5 years?

12 months doesn't seem like a long period to base investment decisions on in something like property?

Posted Using LeoFinance Beta

There's various uses for historical data and the trends they can reveal to a business like the one I work for. For a mum and dad investor there's little value in looking backwards at all, for a commercial client building a shopping centre it is invaluable. 12 months of data? Doesn't mean much when it comes to investment decisions and someone basing their decisions on the last 12 months is sure to make a decision around too little information.

What happened in a five or ten year period may have no bearing on a changing economic environment in the future though, so looking further back doesn't really help all that much either. Times change.

The loss of a major employer, which is what happened in Elizabeth when the GM plant and it's support-suppliers closed causing 20,000 job losses, can force rapid changes and affect the future - Businesses, infrastructure-spending, household spending and house prices etc. The past doesn't really matter at that point, only the now and future. The loss of major projects has the same effect, the submarine and air warfare destroy projects for instance. Knowing what's happening now and in the future is often more important to investors, more so than what happened as there is no assurances it will continue to happen, or that extenuating circumstances could significantly change things. Trends of the past may not endure.

25 years ago people in Australia had the impression property doubled in value every year and to some degree it did, or at least saw steady growth...But times change and that is not the case anymore. Urban infill, high-rise, urban sprawl, demolish and divide, the opening of new land for residential and commercial development, opening of new transport corridors, even the building approval for a mosque for instance, can completely change what may have happened in the past. I mention the mosque thing because the building of a big mosque completely ruined pricing in an area here not so long ago - People left in droves and prices dipped...An area that had always had good rental yield and sales price. The same goes for arterial road building, airport runway extensions etc. Ruins pricing as demand ebbs.

Anyway, I can't answer this in a comment, or a post, or probably ten...It's too complex.

Depends on the suburb and the year, and who is considering the data? If my business is using it for marketing purposes then it can be very valuable, if one of my clients is looking at building a service station then data over the last year from a demographic nature is critical, but they would look further back - And way more distantly into the future...For mum and dad looking to buy a 2 bedroom unit or some such...12 months of data is almost useless. Most investors are not investors...They are people with a rental property - And they often do it really badly.

Depends on what we're doing. When pricing a house for sale or rent maybe 3 months historical, no more. What happened past that time is irrelevant to the present.

For my own needs, personally, I look at the last 3 years briefly...But am more interested in how many new builds the area had in that time, how many building approvals are in council now, what infrastructure is planned in the next 20 years (airports, roads, schools, cemetery's, shopping centres, parks, sports facilities, tram/train/bus routes...Etc.) Also what current house prices are, new builds and the older existing...The same for rent yields, the difference between an older existing house and a new one build over the old. (Sub-division). It's more complex that this but you get the idea.

My post was merely there to show the difference in a pre and post covid environment. I'd never offer financial and investment advice here or encourage anyone to look at anything I post and base decisions on it.

I'm not sure if this really answers your questions all that well. Sorry.

It does kind of answer my question - previous data is not that useful!

Thanks for the insight - there's a lot of variables as I thought there might be - those development plans you mentioned - how many houses to be built and the whole quality of life developments - I guess they're quite difficult to source in data terms! You just have to go on potential.

I guess the best place for a rental is a place where there's lot of good paying jobs for young people. All other things being equal.

Posted Using LeoFinance Beta

It's all done with a few clicks of my mouse butting whilst sitting in my office. We pay exorbitant prices for access to government records, development approvals and applications, titles etc. We can get it all. Most of the development plans we look for are done years in advance and are mostly available...Just the military stuff is locked. It's not in data form though, we have to make it so. Still, we know what to look for so it's not too difficult, just time-costly.

Yep, infrastructure...Shops, schools parks etc. It's all specific to certain countries though as we're all different...Culturally.

This is purely anecdotal evidence but everything I've heard points to rents being down and vacancies being up. A friend that lived downtown had their rent lowered without warning or prior announcement. Downtown has had a lot of new flats/apartments that have just came on the market and they're really struggling to attract tenants, most are still mostly vacant.

Houses are selling like crazy around here, at or above asking price but landlords are struggling to pull in the rents.

Should be an interesting winter is all I know...

Houses are selling here too, the sales people here at my office are all complaining about lack of stock. If the fuckers knew how to build relationships better that may be less of an issue, but that's just me, after 20 years in the industry, (and no longer in sales, thank fuck.)

What's interesting here is that the vacancy rates is so very different region by region. Adelaide can be loosely segmented into north, south, east and west the city is seen as a segment also. I'll do some figures soon showing vacancy and weekly rents just for these segments which really shows some interesting facts, and more relevant to my role. I.e. city vacancy is off the charts high; Mainly due to high rise towers of apartments being built with no tenants available. Chinese buy them and leave them vacant Whole buildings of 300-400 apartments may only have 4-5 occupied. It's crazy. Still, as long as they keep buying they'll keep building. They will own the city soon...As with the other State capital cities.

Hell, the Chinese have entire cities like that already (If you've not come across this before check out https://allthatsinteresting.com/chinese-ghost-cities). I suspect that they're just planning/operating on much longer time scales than we are accustomed to.

Have you threatened the sales people with being replaced by a smart contract yet?

Yeah, I've seen the ghost cities. Mind-blowing.

Lol, yeah, it's a dying profession to be honest, and very hard work in this fickle socio of no loyalty. That's why I'm in management and not on the ground. At 50 I should be able to see it out, would leave now if I could, but for those younger ones...Yep, no jobs in the future.

Congratulations @galenkp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPGood grief. 35,000 replies. I have (cough) not that many. By a huge margin. Congratulations.

I think that means replies to me from others. My outbound comments at 32600. Considering I was aiming for 32500 by December 31st I think it's not too bad. :)

It's still a big number. 3x for me. Though I am above my original comment commitment and a bit ahead of my revised commitment...

Being ahead is a good position to be in. You'll get there.

Yeah, I believe I will get there. Just a thing to do every day. Even with a day like yesterday when I didn't do much...

Dang! $611/week in Sydney? Those are LA prices.

I had no idea

That's a monthly rate in Tennessee and it includes water, washer/dryer in unit and free WiFi.

Yep, that's the average. My sister lives in Sydney and pays $640/week for a 1 bedroom unit. A nice one, but still only 1 bedroom. It's mental. She has a very nice view over the harbour and the Sydney Harbour bridge but it's a lot of money. People are always surprised about the prices here. People must think we all live in dusty little towns...Clearly not the case though.

Here the tenant pays 100% of water usage and properties are mostly always completely empty. Security bond is 6 week's rent, so a tenant needs to have some backing or they have no chance of securing the property. I'm glad I am an owner, not a tenant.

Are you fucking serious?! 6 weeks security? LA is pricey, but even there water/trash is included in an apartemnt. Security is always 4 weeks, sometimes only one.

Hey what's the average income there, Galen? I see prices like that and have to assume LA wages. Granted, I suck at managing fiat is why I always relied on brokerages but even at a low 6 figures a year, living paycheck to paycheck was always common.

Whats the average salary for someone like a city employee (called civil servants here) vs say a restaurant server or an auto mechanic?

Good question.

Weekly (average) earnings for an adult is about $1800 before tax and superannuation deductions. So, about $60,000 a year. Low income earners are on about $40,000-$45,000. Unemployment benefits for a single are $520/fortnight but more due to covid currently.

The $1800/week is a little more for public servants and they have slightly higher compulsory employer paid) superannuation injections. Figures are about $200 less for women.

The problem is wages have not kept up with inflation and is unlikely to do so at any stage of course.

For instance petrol (gas) was $1.70/L prior to covid. Curiously about $1 now though. (4 litres make up a gallon). So, expensive. Insurances, staple foods, power, water and gas (natural gas for household usage), proper medical, school fees etc. is all costly. There's a lot of people struggling here.

You mention low 6 figures...That's the exception not the rule here.

I hope this helps.

LA living is like that, salaries are a little higher than the rest of the country but the thing is we work ourselves to death man. 6-7 days a week, 10 hours/day is common for years on end. I know a lot-lot-lot of people who won't take a vacation and haven't for several years. I used to be that guy

We're comparing rents and securities to pay and I don't know how ya'all afford it! That's some discipline, Australia wages with LA prices--I never knew.

glad you out this article together

I would've had to use my conversion app so thanks for recognizing my indoctrination system. 👍🏿 $4 a gallon?! Sir, that's even more than LA--about $3.75. Here in Tennessee, $1.69/gallon which... wait, hold on....

..

.....

Bout 43 cents/liter. (did I do that right?)

Yep, good math sir, 0.43US (0.59 AUD)

I used to work a lot, my industry calls for it really, but I tend to manage it quite well these days. I am a 9-6 weekdays salaries employee but I'll be honest, my actual contact hours (actually working) is something around 3-5 hours a day usually. I manage to get what I have to get done in that time. I spend a lot of time in cafes with myself, and clients sometimes, but generally I have a lot of flexibility. That makes it tolerable. I'm usually up around 0500-0600 and off to bed around 2330-0000 so I tend to fit a lot into my day, even if that's just watching shows or reading. (Watching Strike Back currently). Life's too fucking short, and far to underpaid to do anything but whatever it takes to live my best version of it.

I know that many probably find this post boring or unrelatable but the weekly rents a city commands is very telling for those who look deeper, as you have done.

Currently the price of fuel here is about 1,40€/L or $6.30 a gallon. before Covid, it was around 1.70€/L or about $7.50 a gallon.

The yearly average salary is about 34K€ = about $40K

Thanks for chiming in @tarazkp, wassup man? That's outrageous. Are your rents comparable as well to LA prices? I don't mean to sound uppity cuz I'm far from it, but you can't live in LA on 40k a year, dude trucks cost that much. You have to be outside the city and, even then, you're gonna struggle with that income in California. You'd have better luck in a mid-west or southern state.

I guess it's likely my culture spends a lot more on stupid shit we don't need than your culture and more regularly, would you agree? If rent's the same and fuel alone is that expensive, add consuming which I'm sure is normal in Finland wether it's a little or a lot, it just seems to me like that majority of Finland would be below the poverty line. Am I way off?

Do tell, sir, I'm all eyes. This shit's fascinating to me.

One thing I learned traveling for two years is it's the only way to learn. Food in my country is so expensive compared to UK and EU. Here, an apple is $2.99, just one (I thought that was normal). Everywhere else, you get 6 of the same apples for $1.

Rent and house costs are way up where I am. And the rental vacancy is next to (if not at) 0. We were doing really well with Covid and that prompted a bunch of people to move here and buy property.

Might be related, or not, but Montana is now in the top 3 daily Covid growth rates in the nation. Not a fun time.

Yeah, it seems to be the way; An area is clear, people go there, and covid becomes rife. Australia is now beginning to repatriate many citizens from around the world and that is likely to exacerbate the situation here. Sucks.

Good luck. I read an article recently talking about how Australia is beating (or has beaten) Covid. Hopefully that is at least partially correct, and stays that way.

We're smashing it down here to be honest, the pandemic side of it. Financially, time will tell. Melbourne had a second wave with lockdowns worse than the first wave that hit the country but States are now opening their borders to the State of Victoria (Melbourne city) and we seem to be under control fortunately.

In Vancouver Canada the vacancy rate is consistently under 1%, I haven't seen our post Covid Rates lately as I have the feeling they are higher than usual. I rent out a legal suite of my home as passive income and I am currently mortgage free so I am not in a Vacancy or No-Rent-tenant-and-cant-evict trap as I have a reliable long term Renter at this time.

I can understand the dilemma some Landlords that are debt leveraged with little income. Some took full advantage of these low rates for too long and accepted the risk even in our expensive housing market until this Covid thing. The Govt has yet provided any relief funding but where does it stop anyway.

Posted Using LeoFinance Beta

There's many factors that contribute to vacancy rates including population size, job-availability and many others. I note that Vancouver has an estimate 2020 population of 2.5m people in comparison to the 1.3m people my own city has. Further to that, Vancouver has an area of 115 square kilometres as opposed to the 3,258 square kilometres of Adelaide...land area often means more population spread and in smaller land areas more high rise (condominium-style) properties which are not popular here. That changes how people live and probably affects vacancy rate quite dramatically.

Adelaide city had a vacancy rate of 7.2% in September. That's a direct correlation to the fact Australian's don't really like apartment living, we have the option to have larger allotments, my own is more than 700sqm for instance. So, developers build apartment buildings, sell them to overseas investors, mainly Chinese, and they remain vacant for years.

In comparison, northern (suburban) Adelaide has a vacancy rate of 0.3 for September. This indicates more desirable properties and better weekly prices. Australian's aren't keen on living in small apartments so avoid them where possible, this skews the vacancy rate figures somewhat as developers put towers up that they sell, (which is their only interest) but then rarely actually tenant-up.

It's difficult to compare city to city, even here in Australia, Sydney is completely different to Adelaide for instance. It's impossible to compare country to country from a vacancy or rent value perspective.

Thanks for your comment. Informative.

Seems odd that my Prime Minister is so gung ho in taking in tens of thousands of Middle eastern and African refugees when I know there are young working families living here homeless and cant afford reasonable housing. We cant get enough affordable housing for our own.

Posted Using LeoFinance Beta

It's the same here, from those nations and others; Further to that they have created a working VISA called a 457 VISA which brings people here for work that could otherwise be given to Australian's. I think it could be done much better.

I see a lot of places closing down and being put for rent and still missing clients. I speak about commercial places, there are so many in good places which are empty. Some businesses really struggle now

Yep, business is struggling and the knock-on effect is commercial property vacancy. That hurts the landlords of course, but probably worse is that many superannuation fund own commercial properties and the lack of income on them affects the growth of peoples investments, mine included. It's a downward spiral, but the mega-rich get mega-richer.

For sure landlords are affected, but most of them will last longer than the tenants. The majority of landlords have more than one basket and plenty of eggs, a thing that we can't say about some of the small businesses

I'm not sure I totally agree here, but it's complicated and because I'm not working won't elaborate. Sure, the tenants have to go bust prior to the landlord, but not all commercial landlords are wealthy people...Many are self-funded retirees who rely on the income from commercial property...And there's always costs to holding property that needs servicing. So anyway, this answer is a complex one and when I'm getting paid to answer it I'll address it. It's not as simple as you suggest though.

Ok I can understand your point of view and I agree with the matter being far more complex. Retirees are indeed quite in a pickle if the tenants leave, putting your entire life savings in one space and have that income disappear is not easy. Definetely a hot topic

I deal with this stuff daily in my job and it's a huge...Of course it doesn't negate the tenant-issue either...It's linked inexorably.